11/19/25

Q3 and YTD 2025 Market Update: Value Has Shifted

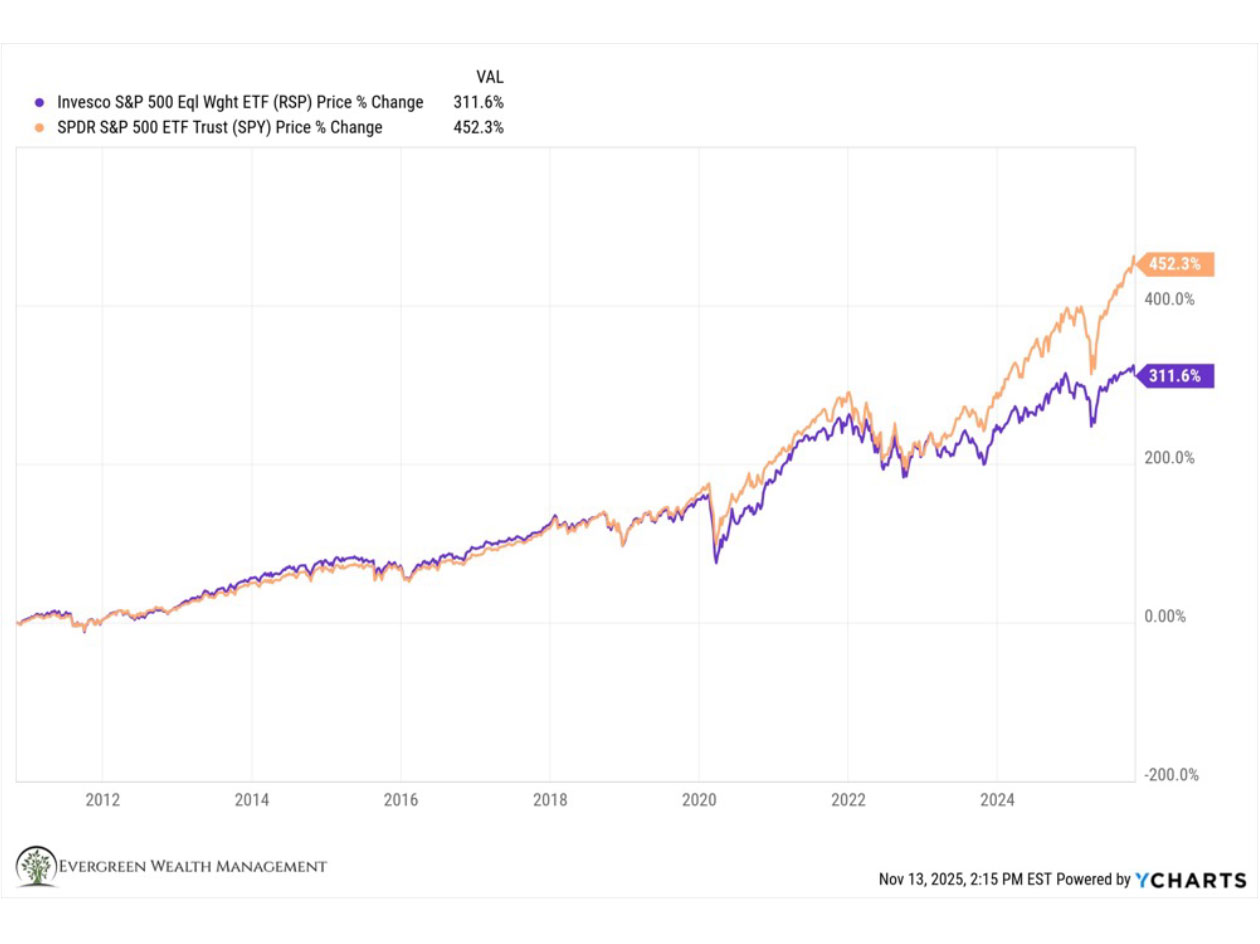

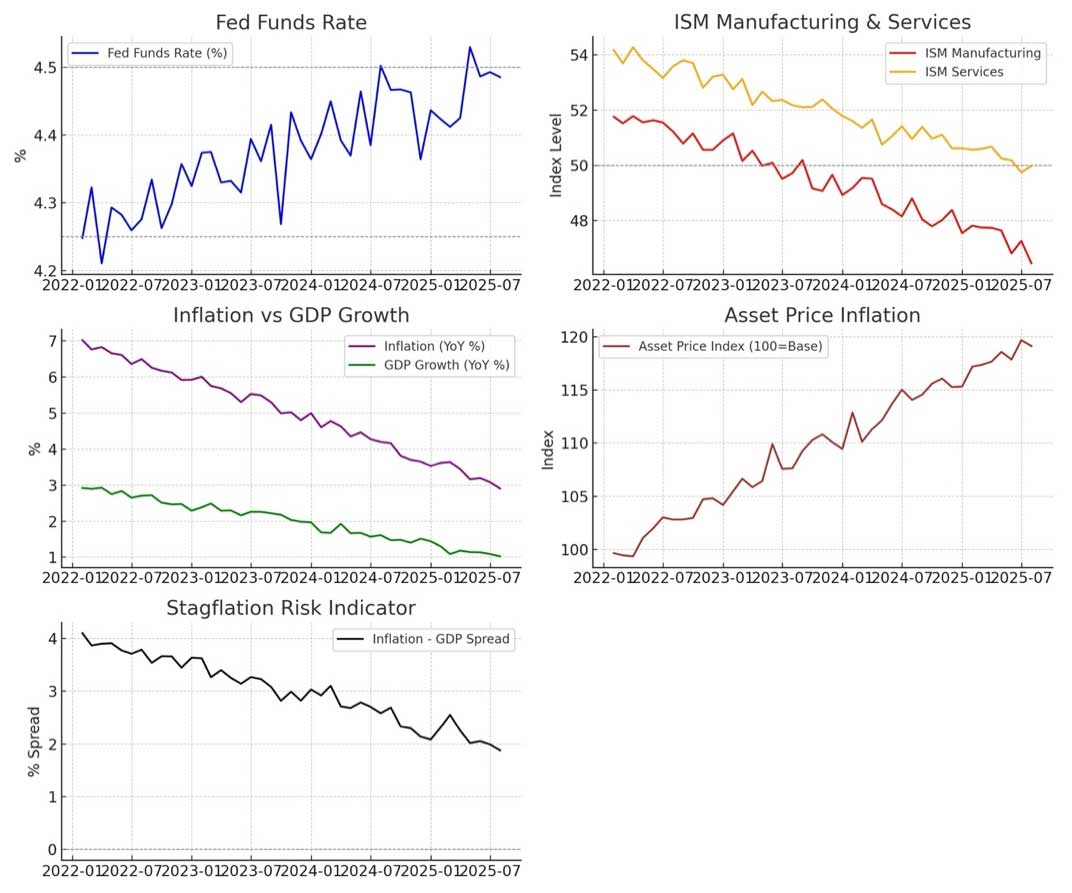

Economic & Market Overview Equity and fixed-income markets have delivered a strong performance year-to-date. As of November 4, 2025, the S&P 500 is up 15.6%, the Dow Jones Industrial Average

Read More