Why do successful Advisors remain balanced and invested if we think a recession may happen?

With all our knowledge, shouldn’t we be able to move out and sit in cash or bonds and wait for a better entry?

This is a natural thought. Think about a professional golfer with a very difficult long putt. If you have never golfed before that’s ok, try remembering back to a really hard putt putt hole. There is always a chance you make the putt. The better you are, the better your chance. Based on this conclusion you would think professional golfers would always go for making the hard putt. After all, they have the skillset to make the putt much better than an amateur golfer would. Ironically, while amateurs keep trying to make long putts with small odds, professionals do the exact opposite and 2 putt with purpose. So, why do so many professionals intentionally opt for a 2 putt rather than going for glory?

Damage Control

If missing the putt will not reduce odds of a 2 putt then of course the professional will always attempt to make the putt. However, when missing the putt may mean catching a downhill slope and possibly leave the professional with a likely 3 putt, they will usually opt for leaving short and taking the certain 2 putt. Even when they have greater than 50% chance of making the initial putt.

The key concept is understanding the damage done if we are wrong. The nuanced ability to properly count all the costs before attempting an action often separates the winners from the losers. In golf, investing or life, it becomes very enticing to go for glory when you have a greater than 50% chance of being correct, but doing so may cost you a great deal in the long run. The proven approach to long-term success is counting the cost relative to the long-term goal. Many market timers forget this concept and Advisors / clients end up paying a steep price for poor understanding of markets.

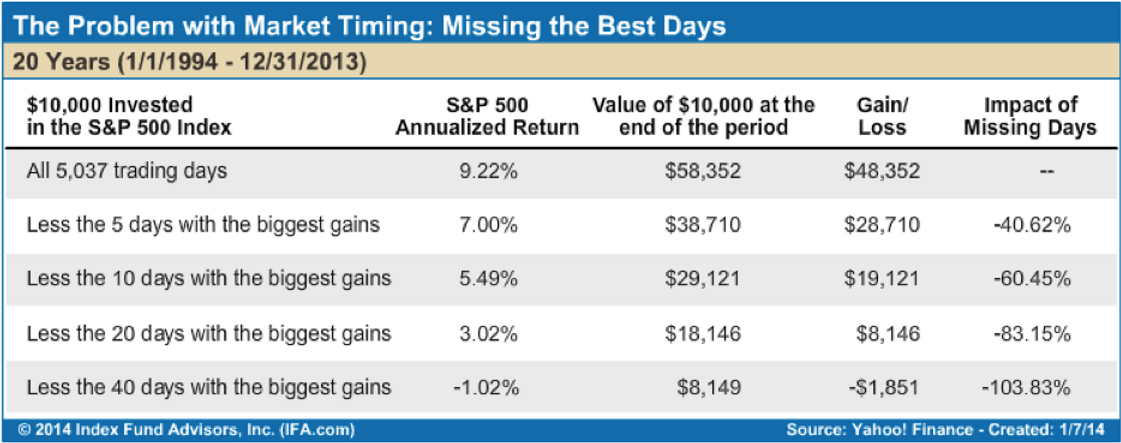

For instance, if an investor stayed fully invested in the S&P 500 from 1994 through 2013, they would’ve had a 9.22% annualized return. However, if trading in and out resulted in them missing just the ten best days during that same period, then those annualized returns would collapse to 5.49%. Missing those days causes large damage because those missed gains do not compound during the rest of the investment holding period. It turns an easy 2 putt into a 3 putt.

We may tell ourselves it is ok to miss some of the best days as long as I do not get the worse days and do not experience as much decline. The predicament, however, is that the worst days happen near the best trading days, making it very difficult to move in and out for benefit.

Even if we are 70% certain a major decline will happen in short term…..we still have a 30% chance of being completely wrong! What if that 30% chance results in missing the best 5 days? This would permanently impair the stock part of your portfolio and perhaps your retirement planning. Staying the course for the stocks within your portfolio has been and will be the most reliable way to meet your goals. It will not feel as good as making the 20 foot putt. But at the end of the round, a bunch of 2 putts…and improved long-term probability will beat out most competitors and get you to your ideal outcome.

Index results do not reflect management fees and expenses and you cannot typically invest in an index.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.