The question on everyone’s mind: When will the stock market rally end?

Since March of 2009, the stock market (‘The Dow’) has experienced a nice recovery and expansion from a value of roughly 6,500 up to over 22,000. This leads to the obvious question you may be asking: “Is the market poised for a big drop, and when?”

Of course, we don’t know exactly when or how much the market will fall. But what we can share with you what we’re watching for, which may provide clues to what’s coming. We will also offer some thoughts on what we’re doing to prepare for it and cost of making large timing moves.

Recession Indicator / Business Cycle Data Review

Below are some of the data points and variables we look at:

-

Bond Yield

-

Freight Index

-

Non-Farm Payroll Employment

-

Industrial Production Index

-

Real Personal Income

-

Real Manufacturing and Trade Sales

-

S&P500 movement, P/E, P/CF, number of profitable companies and Earnings

-

Continuous Claims Seasonally Adjusted / Employment Data

-

Home sales numbers

The key recession probability models we monitor that put these variables together for a more clear framework are:

-

Aggregate Bond Spread Models

-

Business Cycle Index Models

-

Yield Curve Model

-

Smoothed FED US Recession Probability Model

Summary Thoughts from Current Data

The data seems to identify us in the late stages of the business cycle, perhaps even the start of a boom or bubble period. It is very hard to say how long a boom or bubble could last. On one hand valuations seem stretched among some larger growth companies, but we do see some signs of accelerating GDP and economic activity. While the FED may start raising rates more aggressively and offload the balance sheet, technology continues to prop up productivity.

While we are well removed from the last recession, the data currently indicates we may have a little while longer before the next. Of course, market pullbacks and recessions are very different. A 5-10% market pullback could easily occur at any point for just about any reason. However, the more damaging economic declines seems to still remain a little bit into the future. Thankfully we invest for the long term and do not need to rely on economic signals to make gains that meet our goals (akin to predicting the weather at times), but rather we use these signals and variables above for consideration and perhaps carry an umbrella for those who prefer to not get as wet.

We still believe the best defense against a possible market downturn may be capturing the final flurry as we usually push into bubble territory in the late stage. This is good and gives us time to strategically adjust, build some cash, and remain balanced. Not all recessions result in market declines or major market declines, so we need to be careful of allowing the “r” word to force bad short-term investment decisions that could wreck a long-term plan. Easier said than done; but long-term focus, balance, and trimming the tree for the winter to come, is a prudent approach. Any drastic timing moves may have drastic consequences. We will stick with the proven methods.

We tend to be data focused and data driven. Most importantly we attempt to remain balanced and long term focused. However, this may spark a very real follow up question as we get closer to a recession and when / if data changes:

Why remain balanced for moderate or conservative risk takers if we think a recession may happen? With all your knowledge I would feel you could move out and sit in cash or bonds and wait for a better entry.

This is a natural thought. Think about a professional golfer with a very difficult long putt. If you have never golfed before that’s ok, try remembering back to a really hard putt putt hole. There is always a chance you make the putt. The better you are, the better your chance. Based on this conclusion you would think professional golfers would always go for making the hard putt. After all, they have the skillset to make the putt much better than an amateur golfer would. Ironically, while amateurs keep trying to make long putts with small odds, professionals do the exact opposite and 2 putt with purpose. So, why do so many professionals intentionally opt for a 2 putt rather than going for glory?

Damage Control

If missing the putt will not reduce odds of a 2 putt then the professional will always attempt to make the putt. However, when missing the putt may mean catching a downhill slope and possibly leave the professional with a likely 3 putt, they will usually opt for leaving short and taking the certain 2 putt. Even when they have greater than 50% chance of making the initial putt.

The key concept is understanding the damage done if we are wrong. The nuanced ability to properly count all the costs before attempting an action often separates the winners from the losers. In golf, investing or life, it becomes very enticing to go for glory when you have a greater than 50% chance of being correct, but doing so may cost you a great deal in the long run. The proven approach to long-term success is counting the cost relative to the long-term goal.

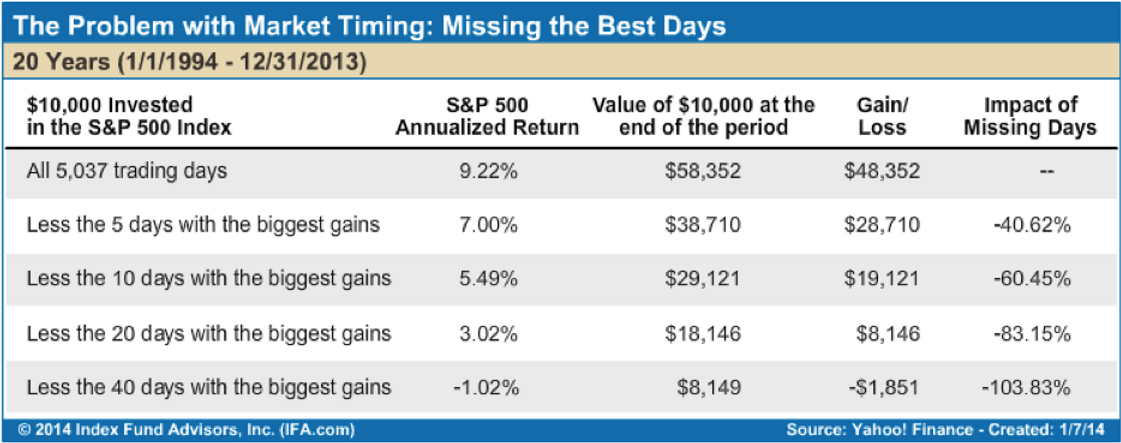

For instance, if an investor stayed fully invested in the S&P 500 from 1994 through 2013, they would’ve had a 9.22% annualized return. However, if trading in and out resulted in them missing just the ten best days during that same period, then those annualized returns would collapse to 5.49%. Missing those days causes large damage because those missed gains do not compound during the rest of the investment holding period. It turns an easy 2 putt into a 3 putt.

We may tell ourselves it is ok to miss some of the best days as long as I do not get the worse days and do not experience as much decline. The predicament, however, is that the worst days happen near the best trading days, making it very difficult to move in and out for benefit.

Evergreen Conclusion

Even if we are 70% certain a major decline will happen in short term…..we still have a 30% chance of being completely wrong! What if that 30% chance results in missing the best 5 days? This would permanently impair the stock part of your portfolio and perhaps your retirement planning. Staying the course for the stocks within your portfolio has been and will be the most reliable way to meet your goals. It will not feel as good as making the 20 foot putt. But at the end of the round, a bunch of 2 putts…and improved long-term probability will beat out most competitors and get you to your ideal outcome.

The best action is small actions. Stay the course with your risk selection. If you want market returns, stay fully in the market. If you desire less risk, balance with diversified bonds accordingly. We are making small moves in the following ways:

-

Selling a few of the stocks we view as having less staying power in recessions

-

Stress testing our dividend yield to validate sustainability to pay income regardless of recessions

-

Allowing natural cash build ups for moderate and conservative accounts to fluctuate toward 10%

We are well diversified and positioned for the next storm. We do not need to make any drastic changes since we have built the portfolio ahead of time for the risk and goals you outlined to us as your advisor. Any declines in markets (stocks or bonds) will provide opportunity long term and we are well balanced if such a shake up did occur.

Please let us know if we can help you find additional comfort in your efforts to prosper regardless of whether markets rise or fall. After all, a successful retirement is all about doing the things you want to do, regardless of what markets do in the short-term.

Index results do not reflect management fees and expenses and you cannot typically invest in an index.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.