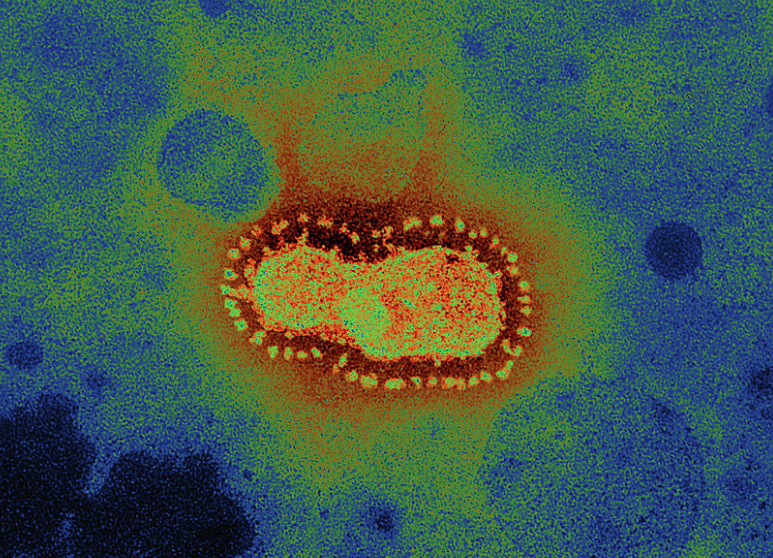

Unless you live under a rock, you have certainly read or heard about the terrible Corona virus afflicting China and spreading to other areas of the world. As of today, we see the markets being spooked by the potential impact that this virus may impart as a result of potential businesses halting and sparking global growth slowdown.

Current Virus Data

Here are some facts to consider before you go buy a Hazmat suite:

-

Total Cases: 79,744

-

Deaths: 2,629

-

Recovered: 25,267

-

Chinas Population: 1.435 Billion

(*Data 2/24/2020 from https://www.worldometers.info/coronavirus/) This is a great link for up to date data!

This represents 0.0056% of people who are sick in China. That not even a blip on the radar….IF the data is even halfway accurate. Of course, we hope the governing authorities can keep it from becoming a major issue and are very appreciative of anyone fighting these diseases at ground level for our safety! The current death odds are near 0.0002% in China and falling. Also, the death rate has been falling quickly since the initial statistical rates started reporting. Early data is usually skewed by those with much weaker immune systems. This disease specifically hits those over 80 similar to a viral pneumonia…but no children thus far. Just a few weeks ago it appeared near a 20% death rate (mainly due to elderly who contracted) and now we are seeing less than 9% and falling for closed cases (with almost all those cases concentrated in elderly). It is a real possibility that the death rate is closer to 5% of those who get infected in China (mainly those over 70) and estimated 1-3% in more developed countries. Perhaps most encouraging is the rate of change decreases that we are seeing with fewer new cases each day. We are hopeful that this maintains. While this fear will impact economies short term as it spreads; thus far the fear and panic are the primary problem and not the disease.

The Market Fear – Is the real virus fear itself?

The markets are most afraid of the business responses to the spread of the Virus. Which puzzles us a little since the death rate remains near 0 chance of death for healthy individual under 60 and the disease remains well below prior pandemics such as H1N1. As the virus goes beyond China, fear (real or perceived) may cause areas to “close up” as they attempt to slow the spread (similar to China’s response). This raises uncertainty in a large way. Anytime the uncertainty is elevated, the markets will decline. Even if the virus gets controlled (or perhaps already IS controlled), the fear and means used to control the virus could have serious economic consequences. Monday, 2/24, large declines were the result of many large companies confirming that the virus will certainly have a material impact on the quarters profits. This virus is having a real impact to short term profits which we fully acknowledge as more fundamental and unique than prior market declines experienced over the recent past. Of course, some of the companies likely had a decline in the works anyways and this provides an easy excuse for any and all declines.

Imagine for a second that the virus slowly works across the globe and some select metropolitan areas like New York and London need to take extreme measures due to population density. Businesses such as Apple store, Starbucks, Costco, etc.. may decide to close for a few weeks to protect employees and slow the spread. Many more people decide not to travel and maybe imports and exports slow down. This type of action can place the brakes on economic activity for a temporary time. This is the emotional narrative being put forth by media and governments. If this plays out, the length of time this fear impacts businesses will be the variable that largely determines the economic impact. We could see a small impact on economic activity or a recession dependent on the scope of shutdowns and fear response. Our base case scenario would be a choppy market and pullback on the fear of large shutdowns rather than a recession, but we acknowledge anything is possible in the short term.

Here are the key questions clients are asking and our responses:

What are the odds massive shutdowns happen?

No one has any idea, which is why the market can get in a panic at times. The scope and length of any economic disruptions is unknown and not predictable. Other things such as a vaccine could also pop up at anytime and help reverse some fears (multiple vaccines are being tested and it seems plausible within 3-12 months we will have a workable vaccine).

Could this spark a recession?

Sure, recessions often happen from something we never see coming. Often from non-logical fear itself that create panics. It is always a real possibility. In the short run, the markets can go up or down for any number of reasons. Considering we experienced a 20-30% increase in 2019, a 10%+ decline is not unexpected, and this may be a great excuse for a pullback. Declines are normal and healthy. They add fuel for next leg up. Long term the markets will reflect profits and we expect good companies such as Apple to still sell phones and make a profit for the next 10 years, and we are happy to keep getting profits that solid companies generate.

What is our response?

We are buying companies and investments for 20-30 years that support specific long-term plans. We see recessions and pullbacks as a healthy part of long-term investing and do not worry about short term impact when focused on 20-30 years. Our primary response will be buying and rotating into more businesses and investments that we desire to own or staying the course. That said, we also may take some profits from last year’s large run up and hold a little extra cash inside the strategies as we seek out the opportunities. We are already seeing some really good deals and if history is a guide, the declines could accelerate quickly, and we want to be ready to act. If the fear subsides, we remain well balanced and invested to continue moving forward. We will never let emotions outweigh common sense investing decisions for the long term!

Conclusion

Uncertainty always creates volatility. However, volatility in the short run should not impact or change a sound financial plan or the investments we own. We have already aligned portfolios and will actively manage to support your long-term plan. The risk management is in place for short- and long-term success regardless of the short-term swings.

“The big money is not in the buying and selling… but in the waiting” – Charlie Munger

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years” – Warren Buffet

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.