“Too Big to Fail” was a term we heard countless times in the aftermath of the 2008 market collapse. But what does it really mean and what lessons should we take from the 2008 decline that are applicable for review today?

To understand, let me give a brief summary of the way banks work. Banks take in your money and are required to hold a small amount in reserves, generally about 10%. They could use the remaining amount you deposited in various ways such as loaning out for mortgages,, businesses, etc.. to make higher interest. This is generally called, Fractional Reserve Banking. A system that has existed for centuries, and likely became formalized in Europe during the mid 1600’s.

The foundation of holding only a small percentage of deposits is based on depositors leaving money at banks and taking at different times. It is rare for a bank to ever payout more than 1% of deposits, let alone 10%. This system works great until you hit a crisis of confidence, when depositors need money all at the same time. These moments of financial panic, when the banks do not have the available funds to pay back depositors generally hold the highest level of fear and present the most danger for destroying an economy. Looking only at the U.S. economic history, we can identify financial panics in: 1792, 1796, 1819, 1837, 1857, 1873, 1884, 1893, 1896, 1901, 1907, 1929 (Great Depression), 1980’s (Savings and Loan Crisis), 2008 (Great Recession).

Something should immediately jump out at you from the dates I just rattled off, or at least it jumps out at a nerd like me! The US Federal Reserve was not created until 1913. Prior to this, very few regulations existed for banks and many that did exist were not followed or enforced. Many banks up until early 1900’s carried little to no reserves for depositors, much less than the small 10% requirement of today. Some of course did, but it was the wild west in banking as well as the country. Hence you get 7 major financial panics and multiple depressions from a less than ideal banking system. Many would argue this also set the stage for the great depression of 1929.

Fast forward to 2008 when we had some very ugly stuff happen behind the scenes at some banks with mortgages, credit default swaps, and other complicated investments. Bottom line, they did not have enough available cash (reserves) to hold them through the economic declines. Yes, they made some bad investment choices BUT the real issue that created a larger problem for all of us was the inability of some banks to settle obligations they made to depositors and others. In short, they ran out of cash. During the great depression banks stopped paying depositors back. Could you imagine going to the bank tomorrow and not being able to withdrawal your balance? Wow, talk about panic! If it happens to enough people, mob mentality settles in and you have a massive run on the banks. Hence, “Too Big to Fail”, was coined as a response to stop this from ever happening in 2008 and avoid turning the great recession into the next depression.

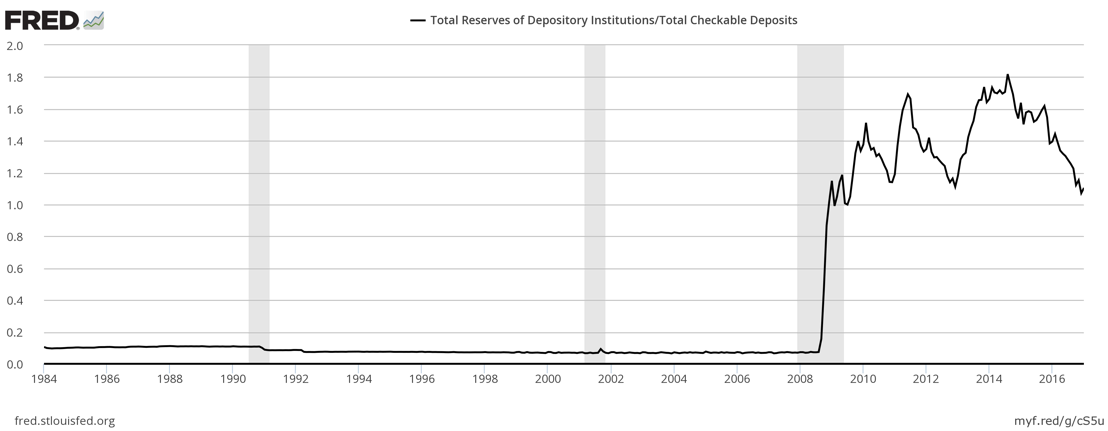

It seems prudent 8 years removed from the recession to ask, what does the health of the banks look like today relative to history? Since 2009 the banks, in aggregate, have maintained 100% of the money deposited into checking accounts on reserve. Prior to 2009, they had operated with the roughly 10% of required reserve.

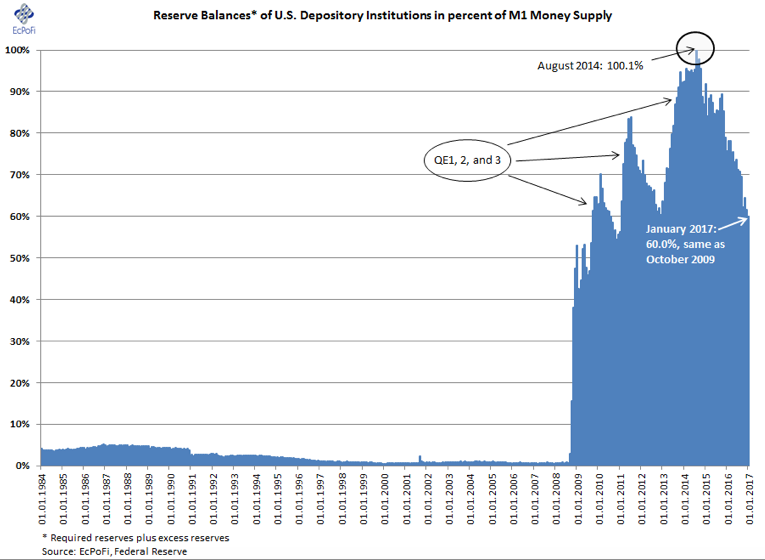

Expanding this definition lets take a look at the cash they hold relative to checking deposits and all money in circulation. Again, the banks look healthier than ever before.

So while banks are only technically required to maintain around 10%, they are holding near 100% of checking deposits which should give them a good cushion if our economy hits any bumps in the road. While it certainly does not mean we won’t have ups and downs, it gives us a certain confidence to know that liquidity and ability to pay depositors during times of stress appears to be very safe. Having this backbone of the economy remaining strong and prudent greatly reduces the truly dangerous declines that have existed throughout history. Of course, over time we very well may see this change and banks again resume minimum cash holdings. But for now we will enjoy a time of bank excess and hopefully the stability it should provide during the next decline.

Evergreen Wealth remains committed to providing holistic investment solutions and financial planning. We remain honored for the trust you place in our wisdom to continue stewarding your assets and retirement journey.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.