A 2015 study found that almost 40 million Americans — about one out of six adults — had provided unpaid care to another adult during the previous 12 months. About 60% of caregivers were women, and the average age was 49. It’s probably not surprising that many caregivers were older, but one out of four were millennials between the ages of 18 and 34. This younger group tended to be split more evenly between men and women.1

About 85% of the people being cared for were relatives of the caregiver. Caregiving for a loved one is a noble endeavor, and considering the high cost of professional long-term care, it may be the only alternative for some families. In fact, about half of caregivers reported that they had “no choice” in taking on caregiving responsibilities. But “free” caregiving can take a physical, emotional, and financial toll on the caregiver.2

If you are a family caregiver, or know someone who is, here are some ideas that may help.

Preserve your own assets. According to one study, almost half of family caregivers spend more than $5,000 annually on caregiving expenses such as medications, medical bills, in-home care, and nursing-home care.3 Some spend much more. Although it’s generous to help an aging parent or other relative financially, be realistic about your own present and future needs. It might make more sense to spend down an older person’s assets, which could reduce the taxable estate and/or qualify him or her for long-term-care benefits under Medicaid.

Take advantage of available benefits. Make sure the person you are caring for has all the benefits to which he or she is entitled. The Eldercare Locator (eldercare.gov), a public service of the U.S. Administration on Aging, and the Benefits CheckUp website (benefitscheckup.org) from the National Council on Aging are helpful places to start.

Also take advantage of benefits offered by your employer. Many companies include family care in their sick-leave policies, and you might be eligible for up to 12 weeks of unpaid leave under the Family and Medical Leave Act. You may want to discuss your situation with your supervisor and human resources department.

Educate yourself. Make sure you fully understand your loved one’s condition, medications, and appropriate methods of care. Ensure that you are authorized to speak to physicians and health providers regarding the patient’s treatment plan. Don’t hesitate to call with questions, and keep a running list of issues for the next office visit.

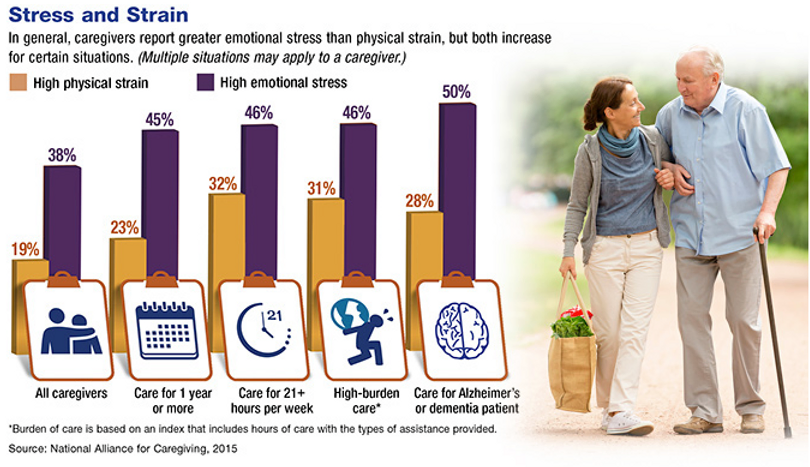

Take care of yourself. Many caregivers suffer from physical or mental conditions that are caused or exacerbated by the strain of providing care. Take regular breaks to rest or enjoy a favorite activity. Ask for help from other family members and friends. Consider support groups. Don’t be afraid to seek professional help for yourself.

More information on family caregiving is available from the Family Caregiver Alliance (caregiver.org), the Caregiver Action Network (caregiveraction.org), the National Institute on Aging (nia.nih.gov), and AARP Caregiving (aarp.org/home-family/caregiving).

See Original Post from our website evergreenwealthmedia.com HERE

1–2) National Alliance for Caregiving, 2015 3) Caring.com, 2014

This information is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2017 Broadridge Investor Communication Solutions, Inc.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.