Resources

11/19/25

Q3 and YTD 2025 Market Update: Value Has Shifted

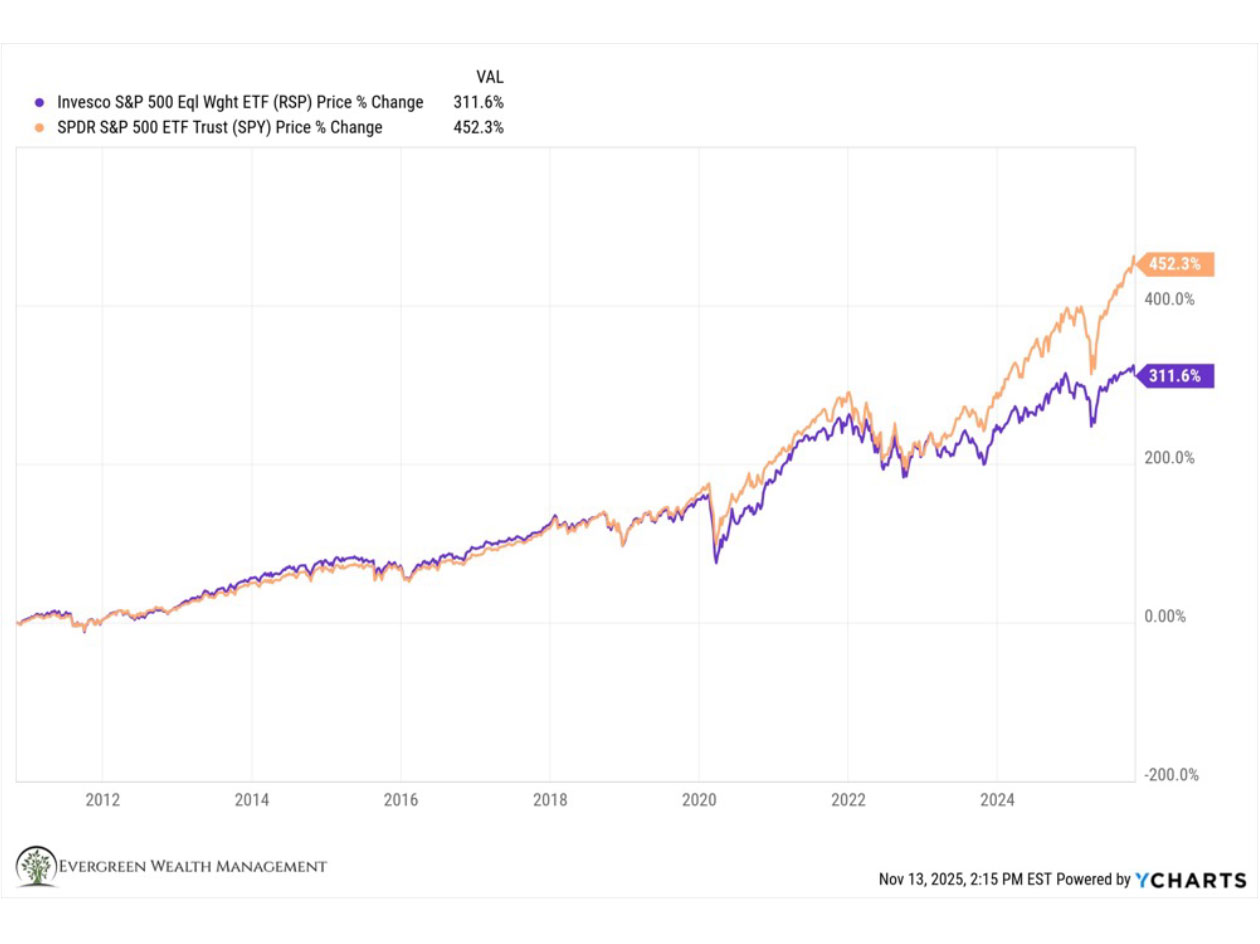

Economic & Market Overview Equity and fixed-income markets have delivered a strong performance year-to-date. As of November 4, 2025, the S&P 500 is up 15.6%, the Dow Jones Industrial Average

Read More

10/09/25

Thoughts About AI

With the “Magnificent Seven” (Nvidia, Microsoft, Apple, Amazon, Meta, Google, and Tesla) now making up roughly 35% of the S&P 500, a few new considerations have entered our thinking. Historically,

Read More

08/19/25

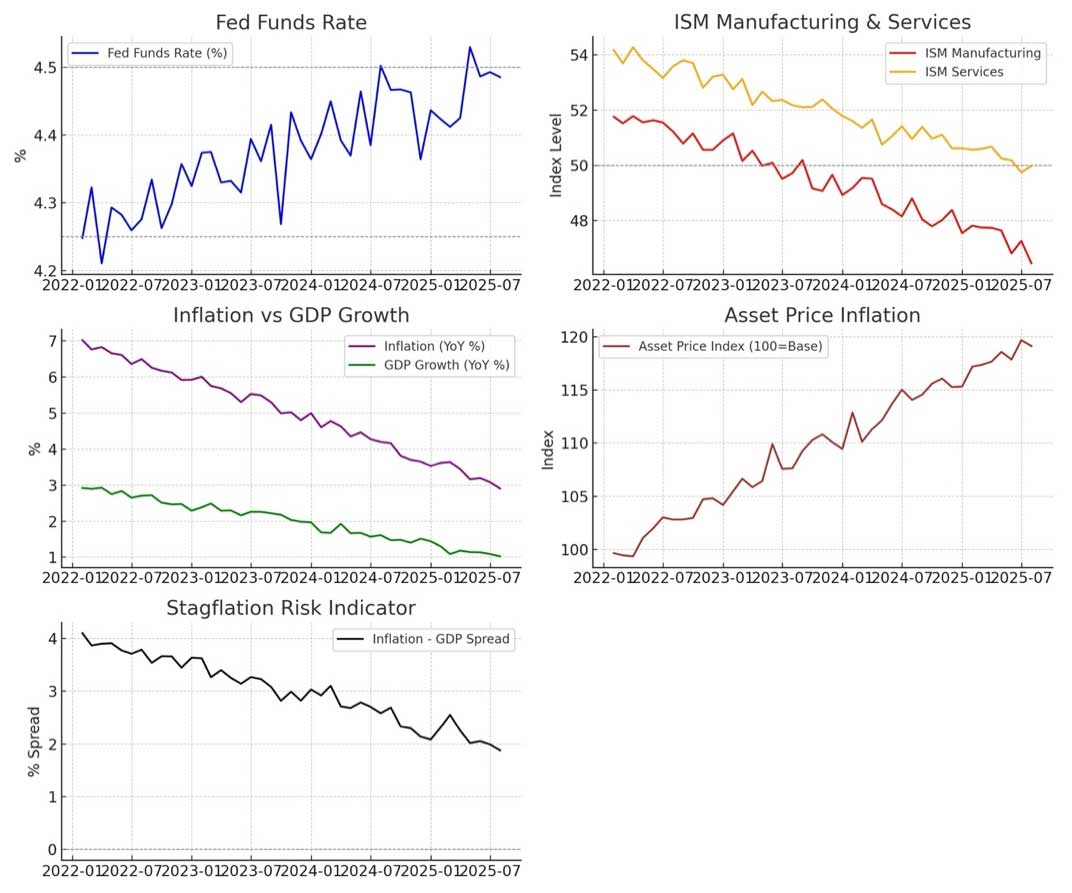

Q2 and YTD 2025 Market Update: The Stagflation Dilemma

Economic & Market Overview Equity and Fixed Income Markets have rebounded to a strong level YTD with the S&P 500 increasing 9.62% YTD and the Aggregate Bond Market jumping 4.91%.

Read More

07/02/25

Independence Day – Foreign Entanglements

The best celebrations bring people together in fellowship, offer moments of reflection, spark meaningful conversations, and create joyful memories. I hope you enjoy what we should all consider a special day,

Read More

05/28/25

Q1 and YTD 2025 Market Update

Understanding Market Valuation and US Deficit Market update interview with Lead Manager Stephen Hanley. My apologies for the slightly later-than-usual quarterly update. It has been a whirlwind of a year

Read More

04/11/25

Understanding Market Turbulence: Navigating Through Recession Risks

As of this writing, the S&P 500 has declined by over 20% from its recent highs set on February 19th. In contrast, the U.S. Aggregate Bond Market (AGG) has risen

Read More

03/12/25

Volatility Has Arrived

Financial markets have recently experienced a decline, with the S&P 500 pulling back nearly 7% since February 19th. As mentioned in our annual letter, increased volatility was expected this year.

Read More

02/14/25

Guiding Your Financial Future: Evergreen Wealth Management’s 2024 Recap and 2025 Vision

To the Clients of Evergreen Wealth Management, As we step into 2025, the team at Evergreen Wealth Management reflects on the privilege of guiding the financial futures of over 300

Read More

01/08/25

Market Update

Market update interview with Lead Manager Stephen Hanley.

Read More