Economic & Market Overview

Equity and fixed-income markets have delivered a strong performance year-to-date. As of November 4, 2025, the S&P 500 is up 15.6%, the Dow Jones Industrial Average 10.9%, and the Aggregate Bond Market 6.7% (Y-Charts data*). These results have propelled many long-term accounts ahead of their planning targets.

Over the past quarter, markets have continued higher, supported by solid earnings growth (in aggregate), lower rates, and easing geopolitical tensions. A resilient economy and expanding corporate profits for many of the large firms—combined with expectations of a more accommodative monetary policy—have created a favorable backdrop for the general equity and bond markets. However, under the surface much of the equity market appears to be diverging to create a large bifurcation of the ‘Haves’ and ‘Have Nots’. The emerging trend is simple; companies directly involved with or loosely associated with the AI ecosystem of capital spending have done well while the companies not associated have lagged. A recurring client question this quarter has been whether we’re approaching a market top or entering bubble-like territory. We think the better question to focus our attention is: Has the Value Shifted?

Has the Value Shifted?

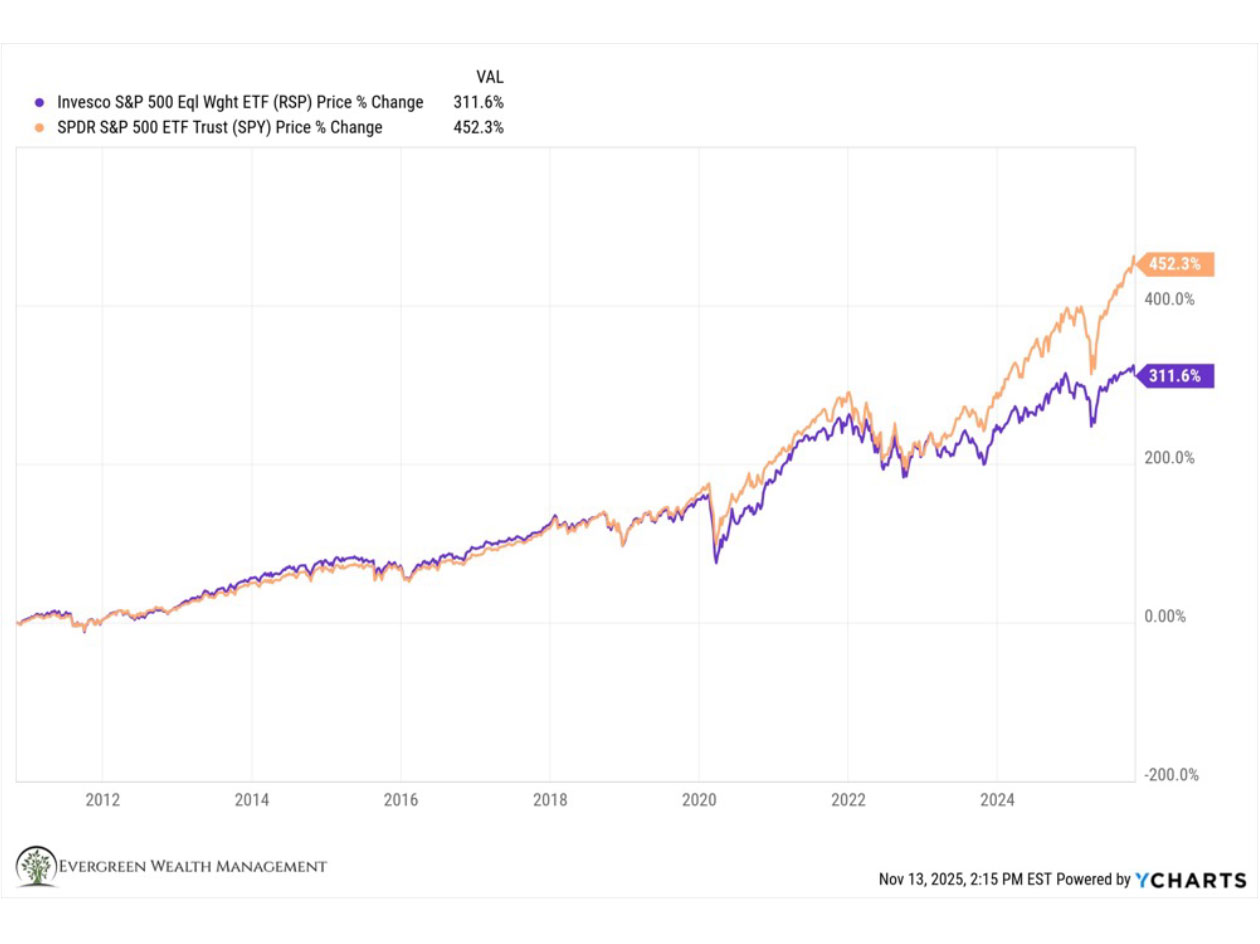

We think the answer is Yes. Consider for a moment the comparison returns of the following S&P 500 indices.

| Index | 1-YR | 3-YR | 5-YR |

| S&P 500 (SPY) | 18.50% | 79.42% | 96.55% |

| S&P 500 Equal Weight (RSP) | 5.45% | 35.04% | 65.85% |

These indices contain the same companies—the only difference is how they are weighted. Historically, their long-term returns track each other closely. Yet the last three years have produced an unusually wide divergence, with a roughly 45% spread favoring the largest, most AI-exposed companies.

The 45% disconnect over the past 3 years seems extreme to us. It essentially highlights the excess flow of money into the larger and generally AI exposed companies. It’s a tale of a bifurcated market with ‘Haves’ and ‘Have Nots’. AI, Tariffs, Inflation have favored a more select group of companies the past few years. Thankfully our exposures the past 3 years have also tilted into this group allowing us to keep pace. However, we think the tides could shift and value has started to emerge inside the ‘Have Not’ basket. While we can’t predict the exact path of convergence, these gaps tend to resolve in one of two ways:

- Equal-weight companies outperform on the way up, or

- They decline less during a market pullback.

Should our expectations play out, it favors disciplined investors who accumulate high-quality businesses trading at reasonable valuations. For this reason, we have intentionally begun increasing exposure to companies in the “Have Not” basket—businesses we believe can offer attractive long-term returns and provide some ballast should the current imbalance unwind.

This is why, instead of asking whether markets have reached a top, we prefer a better question:

Where is the value today?

When we remain focused on the long-term math of profits and cash flows, we believe client portfolios will continue to compound appropriately over the next 5, 10, and 30 years.

Fundamental Profits Drive Markets – Following the Value

Over the last decade (Q3 2015–Q3 2025), S&P 500 operating earnings per share (EPS) have compounded at roughly 11.1% annually, while prices have grown at approximately 13.3%. Over time, profits and prices must move together—markets cannot sustain lasting appreciation without earnings growth.

This decade has seen exceptional corporate profitability. Current valuations, while elevated, remain within historical norms for periods characterized by optimism and strong forward earnings expectations.

It’s worth remembering how these cycles typically resolve. For example, during the dot-com era (1990–2000), EPS grew 8.9% annually while the market surged 16%. When fundamentals and prices finally realigned, the market corrected ~47%—almost exactly what was required for parity.

Historically, reconnection occurs through:

- Profits accelerate while prices pause.

- Prices decline while profits remain steady.

- Both profits and prices contract.

We never know which path the market will take. Our job is to be long-term owners of durable profit streams purchased at reasonable valuations. Warren Buffet summarizes our philosophy best with this quote:

“Nobody buys a farm to make a lot of money next week or next month, or they buy, you know, an apartment house. They buy it based on what they think the long-term future is. And if they make a reasoned calculation of that and the purchase price looks attractive, they buy it and then they don’t get a quote on it every day or every week or every month or even every year, and that’s probably a better way to look at stocks.” Warren Buffett

Implications for Investors

Valuations are somewhat elevated, increasing the probability of temporary pullbacks. Yet multiple paths still exist for fundamentals and prices to realign. The key is not to time markets but to reinforce portfolio discipline.

Periods of exuberance can be difficult for investors who compare short-term performance or chase benchmarks. Those efforts often breed anxiety and reactive behavior. Our focus remains on sustainable, risk-adjusted returns that align with your financial plan—not maximizing gains in every cycle, but compounding wealth prudently over time.

Our central objective is simple: Are we helping you achieve your long-term financial goals? Are we compounding assets at a pace that outpaces inflation and provides a fair return for the risks we take?

As Benjamin Graham famously wrote in The Intelligent Investor:

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting those requirements are speculative.”

At Evergreen Wealth, we will not speculate—whether managing our own money, our families’, or our clients’. We are content owning cash-flow-driven, high-quality businesses within balanced portfolios. If markets become more speculative, our discipline becomes more valuable.

Question of the Quarter – Should I Own Gold?

Given today’s geopolitical uncertainty and inflation backdrop, this is a timely question.

Gold can serve two very different purposes—insurance or investment—and clarity on which applies to you is essential.

As insurance, gold protects against systemic risk: geopolitical shocks, financial instability, and inflationary erosion of currency. For example, when Western sanctions froze Russia’s reserves in 2022, many nations accelerated gold purchases as an alternative store of value, driving prices higher. This type of performance is event-driven and can fade as conditions normalize—much like an insurance policy that gains value only in crisis.

As an investment, gold tends to perform best when real (inflation-adjusted) yields are negative or growth is weak. Between 2018 and 2024, when 10-year real yields turned negative, gold prices surged from ~$1,250/oz to over $3,000/oz. This illustrates how gold thrives when investors seek stability amid economic stagnation.

Our View: Evergreen Wealth maintains a neutral stance on gold. We acknowledge its value for diversification and emotional stability but generally prefer assets that generate predictable cash flows and earnings power—factors that enable deeper valuation analysis and higher conviction in our long-term discipline. Still, for clients who find comfort owning gold, it can serve as a stabilizer that helps them remain patient and invested during volatility. Ultimately, the best portfolios balance risk, return, and emotional comfort—tailored to the individual, not the market cycle.

Final Thoughts

Same focus as prior quarters. We are continuing to take a balanced and cautionary stance. This could potentially mean giving up a few added percentage points of performance this year and in near future across all our management in a trade for focusing on protecting planning objectives long term. We will continue this subtle positioning of protecting against downside real risks while remaining open to upside surprises. We continue to lean in toward valuation discipline, following the profit and diversification.

Thank You

Let me again say—thank you. Our success is a shared result of great clients, great advisors, and a dedicated team. We’re incredibly grateful to wake up each day and do the work we love. It’s an honor to steward your hard-earned capital and walk with you toward your long-term goals.

Please reach out anytime with questions or thoughts.

Warmly,

Evergreen Wealth Management

Disclosures

*Data provided by YCharts reporting.

Index and ETF results (e.g., DJIA, AGG, S&P 500) do not reflect management fees or expenses and are not directly investable.

Evergreen Wealth Management, LLC is a registered investment adviser. This commentary is for educational purposes only and does not constitute an offer to buy or sell securities. Investments involve risk and are not guaranteed. Always consult a qualified financial advisor or tax professional before implementing any strategy. Past performance does not guarantee future results.

Views expressed reflect the firm’s opinion as of the date indicated and are subject to change. Forward-looking statements involve uncertainties that may cause actual results to differ materially.