Q2 2022 Update – Recession Has Arrived…Maybe?

The economy has officially experienced 2 quarters of negative GDP growth (barring an upward revision) and looks like it may continue to struggle for a bit longer against a backdrop of higher inflation, higher rates, and increasing unemployment. Is this a recession or not has dominated many of the headlines. As long-term investors, it really should not make a huge difference. Recessions come and go over time and are a necessary part of long-term investing. Historically they last about 11 months with some closer to 6 months and others, like 2008, lasting 18 months. The economy has certainly slowed from its stimulus-induced highs …as everyone should have expected. Recession or not, we certainly expected a 6-12 month cool-down period after an incredible market run-up. Even with the economy slowing slightly, most companies have continued to report solid corporate profits. In the end, corporate profits drive long-term stock growth and we remain pleasantly surprised at what we have seen. More on this later.

Second Quarter and YTD Market Returns

In Q2, Markets responded with the Wilshire 5000 (our stock market benchmark) declining by -17.63% and was down -22.49% as of 6/30/22. However, since then the picture has gotten a little brighter and now is down -14.43% for the year as of 8/8/22. The Barclays Aggregate Bond Index declined by -4.64% in Q2 and was down -10.23% as of 6/30/22. Things have also gotten a little better for the bond market since quarter end and the aggregate bond market is down -8.84% as of 8/8/22. *Data provided by Folio Institutional (1)

Why the Decline? Inflation and Recession Fears

It was a nasty quarter, but the last few weeks have shown some promise that we may be working through the worst of it. Much of the decline is a result of valuation adjustments combined with the longer-term ‘deep’ recession fears. The market is attempting to find equilibrium for valuations relative to an expected neutral (baseline) fed rate moving forward. This ‘uncertainty’ around interest rates has created a good amount of decline. Since the fed is responding to inflationary pressures by raising rates; the main variable driving markets remains inflation expectations.

We are starting to get cautiously optimistic about current levels. Barring a second major geopolitical issue; we may see inflation start to normalize. The federal reserve is likely to wait until all the data shows normalization before it makes any clear signal of ending rate hikes. Some data points that are pointing to inflation peaking:

- Copper Prices have dropped near -20% since 4/1/22

- Gas Prices are down -16% since 6/13/22

- Lumber prices have normalized from a peak of near $1500 in March back to $528

- Packaging costs, Iron Ore, and Shipping costs have all moved down significantly

If these data points continue, we would expect inflation to begin moderating between now and year-end. Our current slowdown (…maybe a shallow recession) has already greatly curbed demand expectations. If this continues it becomes a simple time lag before we see the actual inflation data reflect. A simple example of the time lag of inflation can be thought about in a trip to the hardware store. Inventory purchased by Home Depot in March at peak lumber prices may not hit shelves until months later and will cost more. So even when the raw material prices are declining the consumer would see their shopping bill go up because of time lag. It takes time to work that inventory off and as new inventory is purchased at lower prices you will see prices start to decline. Inflation takes time to work through the system much like a mouse through a python. Only AFTER it has worked all the way through will we see the Federal Reserve begin to give us clarity. The Federal Reserve is going to interpret data only AFTER the data has happened and not in real-time. We suspect the Federal Reserve may offer much-needed clarity on interest rates closer to year-end. However, the markets could very easily price in the expectations months in advance.

Pessimism is Our Friend

“When investing, pessimism is your friend, euphoria the enemy.” Warren Buffett

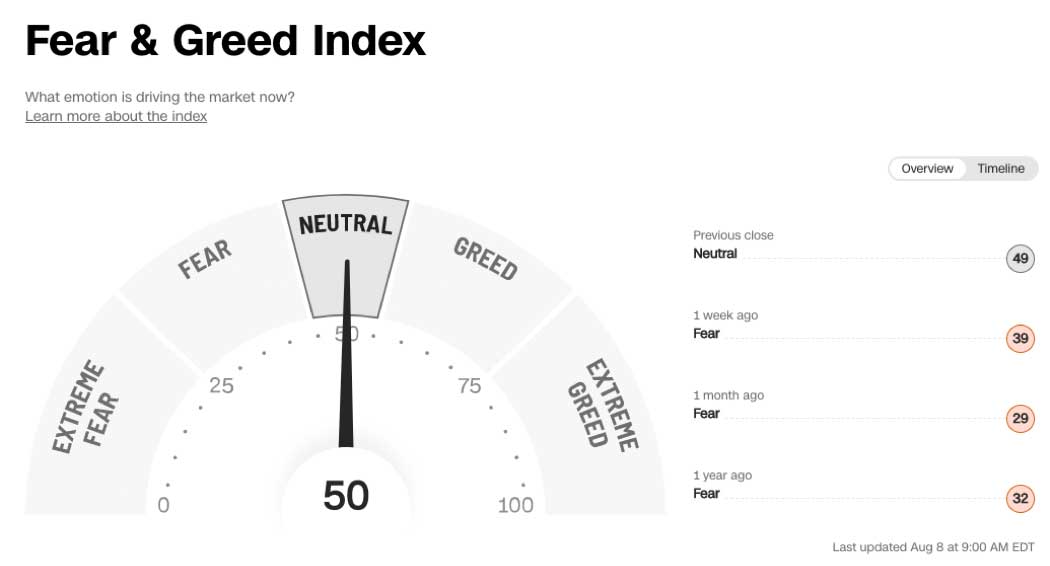

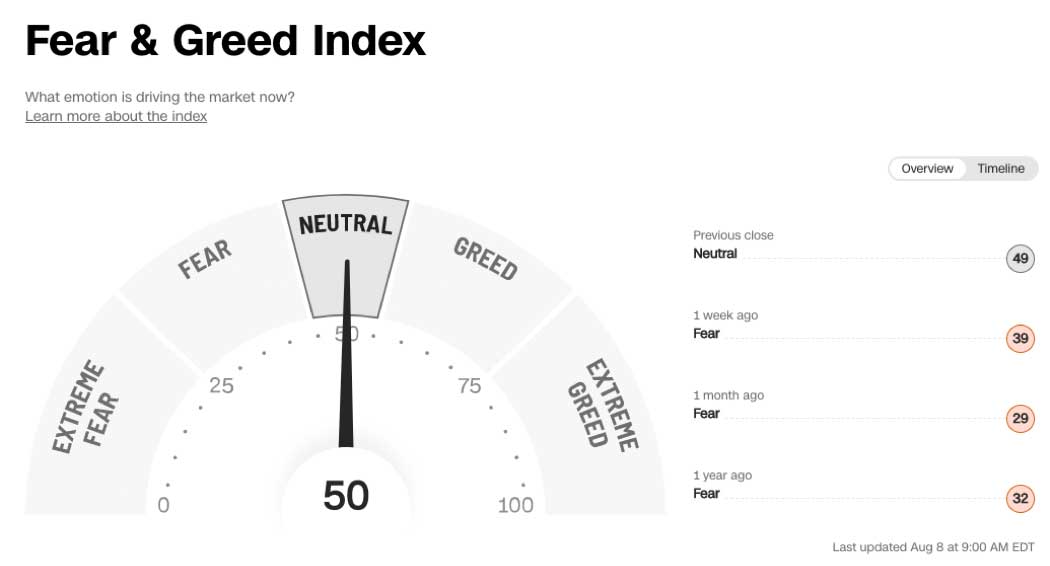

Another potential reason for optimism is the level of fear we see among investors. Extreme fear usually means we are closer to the bottom and generally has been a good entry point for long-term investors (those with a 5-10 year time horizon). 1 month ago those fear levels had become pretty extreme relative to still solid corporate profits. Today we are back to a more neutral fear level.

This is Not 2008

We think many investors are dreading a 2008 great recession. It makes sense to correlate a recession to the last one experienced. However, not all recessions are alike, and inflation-induced recessions are drastically different than a systemic financial crisis. Generally, inflation-inflicted recessions are significantly less severe than credit-induced recessions.

Today’s potential recession is a result of excess liquidity, largely driven by COVID-related fiscal and monetary stimulus that pumped money into the system and created a sugar rush leading to excess demand at a time when businesses cut supply.

This difference is of huge importance. Historically, damage to corporate earnings tends to be more modest during inflation-driven recessions. For example, during the inflation-driven recessions of both 1982-1983, when the Fed raised its policy rate to 20%, and 1973-1974, when the rate reached 11%, S&P 500 profits fell 14% and 15%, respectively. This compares with profit declines of 57% during the Great Financial Crisis and 32% during the tech crash. – Morgan Stanley Wealth Management Research

This makes intuitive sense. While valuations must adjust for higher rates and a short-term profit decline; eventually companies will emerge with similar profits as a result of the higher price of goods created via inflation. Owning companies that can maintain margins and pass price pressures along will be key to solid performance.

Contrast this result to 2008 when we saw credit implode at a time when banks were massively over-leveraged. Today we see the opposite; banks having very solid balance sheets and a desire to continue loaning money at fair rates. We see a healthy housing market with good supply and demand numbers. If anything, we need more homes built long term, not less! The labor market remains strong…if not a little overheated still AND corporate balance sheets are among the strongest in decades. These variables stand in stark contrast to 2008.

Putting it all together, we see reasons for long-term optimism. The markets bottomed out on June 16th at -24.02% for the Wilshire 5000. Inflation may have already peaked, and we are waiting for data to confirm. We may be in a recession currently, but not all recessions are alike. Recession years do not always turn out bad and as long-term investors, it is very wise to stay the course and look for opportunities. I think most investors do not realize how market returns have done during recessions. Thinking has become very blurred as a result of the terrible 2008 recession. Below is a great reminder of history:

Let me end with this Warren Buffet quote:

“I would say that at any given point in history, including when stocks were their cheapest, you could find an equally impressive number of negative factors. I mean, you could’ve sat down in 1974 when stocks were screaming bargains, and you could’ve written down all kinds of things that would’ve caused you to say, you know, the future is just going to be terrible. And similarly, at the top, you know, or anytime, you can write down a large list of things that would be quite on the bullish side. We don’t pay any attention to that sort of thing. I mean, we have, you might say that our underlying premise — and I think it’s a pretty sound underlying premise — is that this country will do very well, and in particularly, it will do well for business. Business has done very well.” Warren Buffett

As always, we never know exactly what the future holds. The market will continue to go up and down to some extent in 2022. We remain laser focused on the real business values and aim to maintain a healthy group of investments that can compound in line with your long-term financial plan. If things worsen we will continue to opportunity seek for investments that align with your own personal goals.

Let me again say THANK YOU! Our success together is an equal part great team, great advisors, and great clients. We feel extremely blessed to get up every day and do exactly what we love doing. If we did not serve such great families, we would not love what we do nearly as much. It remains a tremendous honor to steward your hard-earned assets and continue helping you meet your long-term objectives. Don’t hesitate to reach out if you have any questions or concerns.

Disclosures

(1) Data reported by Folio Institutional. (2) Data reported by Y-Charts Data, www.ycharts.com.

Index results such as the Wilshire 5000 and S&P 500 do not reflect management fees and expenses and you cannot typically invest in an index. Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.