Highlights

-

Strong market price growth in both stocks and bonds

-

Reversal of Fed stance on interest rates causing rate declines and a market rally

-

Continued trade tension between China and the US

-

Weakening economic backdrop from trade tariffs

-

Overly controlling FED could lead to problems down the road

The second quarter continued this year’s steady climb. The Wilshire 5000 Stock Index added 3.42% while the Barclays Aggregate Bond Index added 3.00%. This moves stock returns over 15% for the year and the aggregate bond market over 6%. *(Source Folio Institutional Custodial Reporting)

Accounts have moved forward nicely, in line and exceeding long term planning objectives. We remain pleasantly surprised about performance and market returns year to date. When the year began we expected recovery from the 2018 declines and we have again marched forward to new highs. Going forward we expect a continued battle between interest rates and trade policy to shape near term results. Long term we believe companies and markets will adjust and continue to reward the patient investor with fantastic results.

Federal Reserve Reverses Course

In 2018 the FED completely missed the mark in understanding the global economy and hiked rates a little to fast. We are very pleased to see them reverse course in thinking. In typical FED fashion, rather than simply stopping the rate hikes and let the markets react and digest, they are likely going to attempt to cut rates and fuel markets in anticipation of weaker growth. The history of the FED has been marred with overreaction, both good and bad. In our opinion, they would be well served to simply leave things alone and let the markets be…markets. This said we do prefer the federal funds rate stop increasing and perhaps decrease a bit to provide proper stability relative to lower global rates. Over the next 12 months, it appears the FED will be a tailwind to the market and is committed…in their own words…. “to act as appropriate to sustain the current economic expansion”. With the FED balance sheet at nearly 20% of the economic GDP, anyone trying to time the markets or waiting for a better entry may very well be fighting the fed. They (and corresponding depositors) have ample reserves to release into the economy that could provide support or further expansion. One of our biggest variables for thinking a recession could happen in late 2019 or early 2020 was the hawkish action of the FED. With them reversing course so dramatically, it completely changes the predictability of any recession (if there is such a thing) and very well could expand this bull market even longer.

*Side Note: great read on details of FED balance sheet and what has happened since 2008 crisis. Click HERE to read.

Trade Tensions Continue

The FED reversal was linked directly to the ongoing tariffs and trade tensions with China. According to the FED minutes, those closest to the trade negotiations gave them a reason to expect a significant economic slowdown. The combination of higher rates and trade disputes would have eventually landed us in a recession. However, as mentioned above, it appears the FED will take a measured pace to offset negatives from the trade tension. This is an interesting response at about the time China will start running out state-sponsored stimulus. We believe the negotiations will eventually land an agreement and are hopeful it will come sooner than later.

Equity Valuation Thoughts

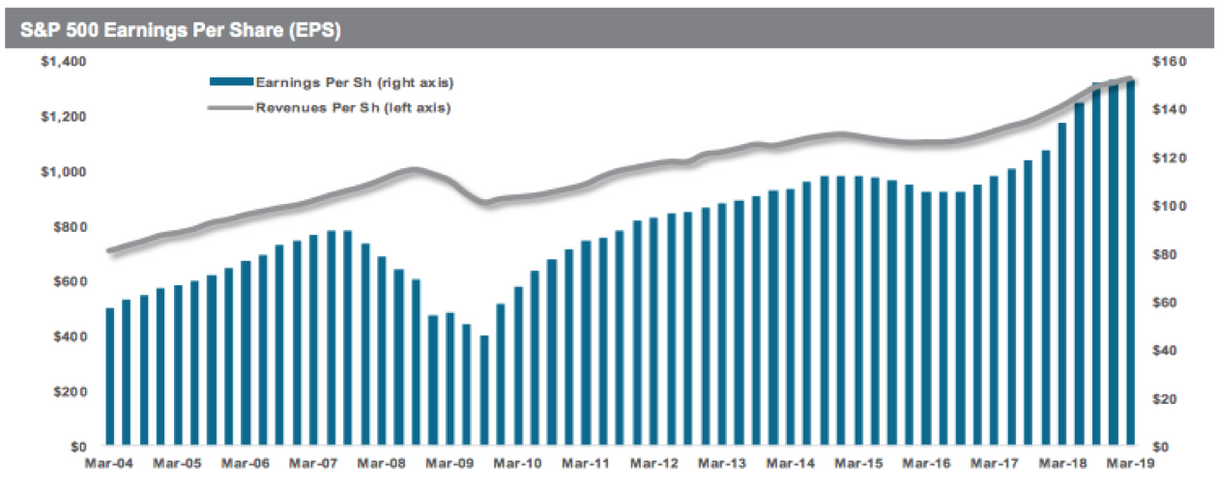

We continue to hear and speak about the length of the stock market and economic recovery from the 2008 recession. It should be pointed out that in 2007 we did not have poor valuation. We were nowhere near a bubble in stock pricing. In fact prices in 2007 were very reasonable. It was a complete erosion and broken financial system that caused the collapse. Today, that same system is flush with excess reserves and very stable in comparison. Long term we know that profits will drive growth. Currently, the S&P 500 is spitting out almost $150 of profit per share of the S&P 500. With the S&P 500 at around 2,964, this is roughly a 5.1% earnings yield.

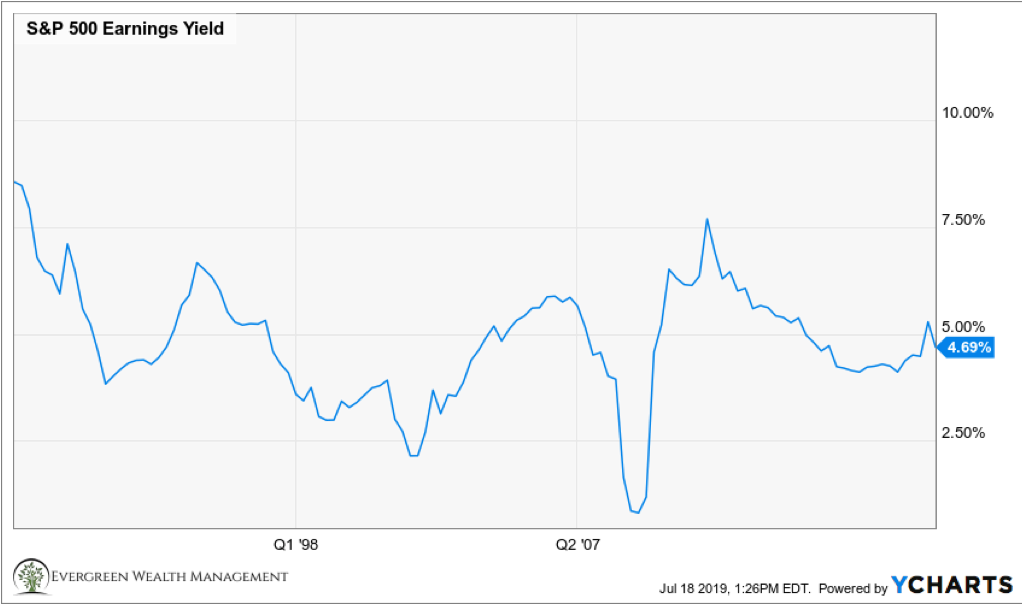

Historically a 5.1% earnings yield is fairly normal. It is neither excessive nor super cheap. Getting a 5%+ profit yield AND potential for growth generally meet most needs in a lower inflation environment. You can see how historically we are NOT overvalued in the stock markets by any means:

What is not fairly normal is a 2%, 10-year treasury rate! If we assume the stock investors need to get at least 2% above a bond investor to compensate for risk then stocks getting 5.1% is significantly higher than 4%. This would imply the S&P 500 should be trading closer to $3,800 OR almost 30% HIGHER than today’s current market.

But here is the rub. Markets are smart and realize 2% rates are fairly low and likely a bit too low long term. Using a little common sense, let’s say rates should be somewhat stable now between 2-2.5%. This leaves us with a fair market value for the S&P 500 between $3,000 and $3,800. If we see a deceleration in profits it might be possible to see another 20% decline, but with the FED responding by lowering rates, it seems we have a good base for near term price growth IF rates stay well below 3%.

Our Concern

The above all points to a clear problem. There is way too much debt in the world, most specifically corporate and government. The FED learned that rates significantly above 2% will place undue stress on the system and greatly increase recession risks. So how in the world can you “normalize” the system back to higher rates with so much debt? The answer is…YOU CAN’T. At least not without taking your medicine. Governments, corporations MUST cut spending, pay down debt and get budgets aligned to create the most ideal long-term outcome. The economy MUST go through a mild recession to sweep it clean.

We are concerned about Negative Interest Rate Policy creating the next fundamental problem. Europe is in a no-win situation with many low and negative interest rate loans/bonds. If it is possible to eventually get money for free or better yet…take a loan and get paid to take it, then how should we think about stock valuations? Stocks should be worth 10X what they are today if rates approach 0, which would cause our markets to enter a huge bubble. Our worry, in a nutshell, is the FED controlling markets with excessively low rates. They have a big hammer to swing with interest rates that will have ripple effects for years to come both good and bad. While we cannot fight the FED, we will certainly be very aware of any bubble being created and do our best to avoid fallout. As it stands now, this still appears to be a long way off. Let’s hope the FED can simply hold still for a while, and perhaps even welcome a shallow recession instead of stoking bigger problems.

Put it all together – Evergreen Conclusion

We have little ability to predict or control the timing of asset growth or future economic risks. Things well beyond our control will move asset pricing over time. Long term investing is not about controlling but rather an understanding of the process, historical truths and meeting long-term objectives. As long as profits continue to grow, then markets will eventually increase. There will always be a few periods of decline and reset, but over 10-year periods we fully expect profit and thus market growth.

In the near term, we understand the battle between negative trade results and positive FED actions will create a tug of war on the economy and Wall Street emotions. Long term this is white noise that solid companies and investments will adjust and overcome. While we believe there are real areas of concern that need to be addressed, we understand many variables will alter the end game results. We fully believe the US economy and markets continue to be the undisputed champion for long-term passive wealth accumulation. We are all very blessed to be part of this economic engine and the fruits it has provided.

Evergreen Wealth remains committed to providing holistic investment solutions and financial planning. We remain honored to continue stewarding your assets and retirement journey.

Index results such as the Wilshire 5000, Barclays Capital Aggregate Bond Index, and S&P 500 do not reflect management fees and expenses and you cannot typically invest in an index.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.