Q1 2024 Market Update

Markets moved nicely higher in the first quarter, powered by some rate-cut optimism alongside positive earnings growth. As of 3/31/2024, the All-Country World Index (ACWI) had moved forward by 8.21%* and the Aggregate Bond Market as measured by Barclays Capital Aggregate Bond Fund (AGG) had declined -0.74%*. Another nice quarter to follow up on a strong 2023. Nice to see markets pushing back toward highwater marks.

Note on Inflation and Fed

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman

During COVID, excess liquidity was poured into the system. It’s like a faucet filling the bathtub. If the drain is open, you need to turn the water on to keep the tub full. In 2020/2021 the water was turned on full force to the tune of a $3 trillion injection via ‘quantitative easing’ from low rates, direct loans, and grants to businesses among other injections. This works until the drain is plugged. Then the water starts to spill over (excess inflation) creating a mess. The faucet’s water flow must be reduced. But imagine as you reduce the water from slowing the faucet speed it also causes the drain to open and close in strange ways. This is exactly what’s happening at the moment. Think of the drain as the many facets of our economy surging and contracting in various ways. Figuring out how much water can come from the faucet (Added Liquidity) while not causing water to pour over but also not causing the drain to swing wide open is a huge challenge. A challenge we still remain a bit skeptical about being navigated long term… but so far the Fed has walked the tight rope fairly well.

Behind the scenes we like to look closely at the ‘water levels’ in the bath tub. A great measurement is called the ‘FED Net Liquidity’…a measurement of real liquidity (money) being added to our economy from the Federal Reserve. This measurement declined nearly -23% from 1/1/22 to 10/10/22**. The Fed was effectively turning the faucet off to reduce inflation. Of course, this also corresponded to a very large market decline over the same period in 2022. This is a timing we don’t find as coincidence. However, the drain started to open up and the economy was breaking in various ways such as bank stresses and failures in late 2022. Realizing this, the Fed turned the faucet back on and from 10/10/22 to quarter end 3/31/2024 the Net Liquidity increased +46%**. This liquidity back and forth is likely to continue for some time as the Fed attempts to normalize inflation all the way back to pre-COVID levels. Some of this action will undoubtedly spill over into the markets in the short run. 2022 was a bad year as the Fed reduced liquidity while 2023 was a great year as they increased liquidity. The common saying ‘Don’t fight the Fed’ has played out consistently over the last few years. In the short run, having markets swayed by forces of government is not an uncommon theme. However, as we look out over the long term, we see the major variable of importance as continued growth of real profits per share.

For the nerds out there and a full disclosure of definition ***Fed Net Liquidity = Fed Balance Sheet – Treasury General Account – Reverse Repo

Now, let’s talk about real fundamentals…Profits per Share

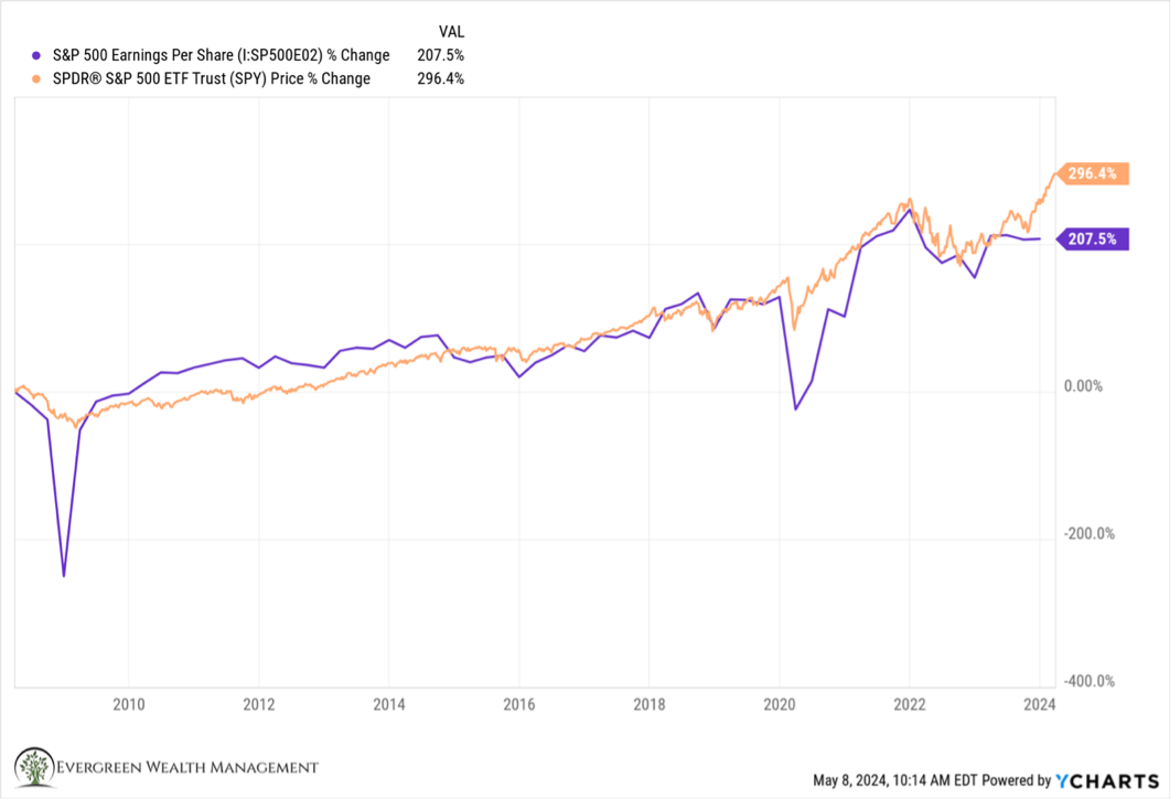

S&P 500 Earnings Per Share growth and S&P 500 Return the past 20 years:

Over the past 20 years (3/31/2004 to 3/31/2024) the profits per share have grown about 208%**. That is around a 5.8% annual growth rate. Over that same time, the S&P 500 has grown 296%**, which is around a 7.12% annual growth rate. Please note for an apples to apples comparison, I did not include dividends reinvested.

Looking at the chart, you can see an aggressive disconnect is starting to form in the past few months. At some point, gravity will set in, and markets will revert to long-term profits per share growth OR profits per share need to catch up to the market. Some combination of both is likely…a small pullback but continued profit growth would be an ideal situation. Either way, these cannot be disconnected forever. We are keeping a close eye on the recent disconnect as markets perhaps start to get a little ahead of fundamentals. The gap will close slightly as Q1 earnings are finalized but we still expect markets to show as slightly overvalued.

Market Timing vs Opportunity Spotting

We do not market time because the variables of how markets play out are so unpredictable. We prefer high probability compared to rolling dice. Maintain diversification relative to your risk profile and then trim and rotate into opportunity seems a much higher probability. We aim to avoid the extreme mistakes that happen with large market timing assumptions. What if the Fed raises liquidity, or profits per share have an unexpected jump, or we get a quick 10% correction and then the Fed cuts quicker than expected…the list of possibilities that could sway markets up or down in the short run is very high.

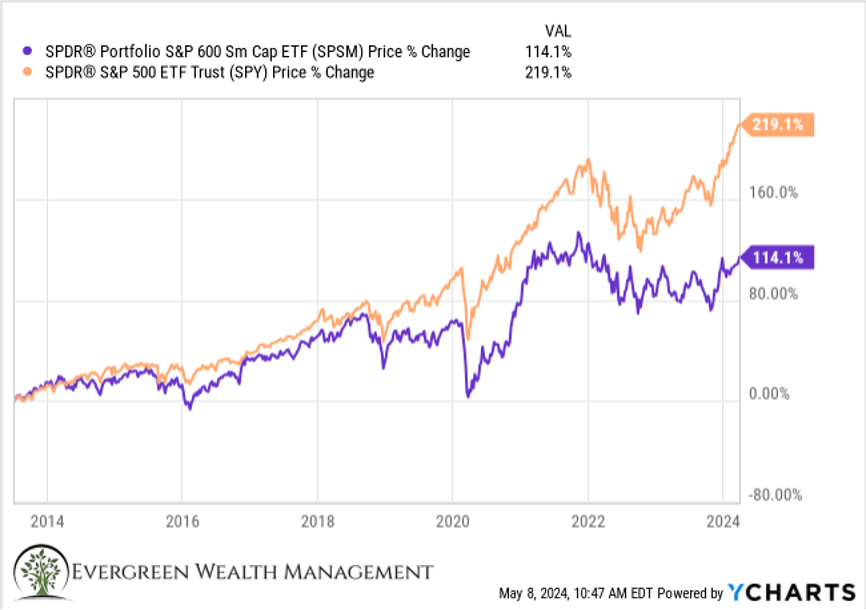

As such we play the long game and focus our management team’s skillset on being opportunity spotters. To give an example; we are starting to look very closely at select opportunities in the mid and smaller-cap companies. Below shows a huge performance gap that has appeared over the past 10 years between large and small-cap companies. It is easily explained with the aggregate small cap index profits per share greatly lagging the larger companies. Many reasons exist for this such as access to international expansions, access to hyper-scale, business models, access to the cheap cost of capital, and new technology, among others. The conditions for larger companies to outperform have been ripe for the past 10 years. Many of these same conditions will persist but as a result, some really solid companies have experienced subpar growth within small caps relative to profits per share growth. It is a hunting ground for opportunity on a very select basis and an area we are adding more attention to.

Note about the AI Hype

Some of the recent surge in markets is undoubtedly around the AI hype. To this hype, I want to add some words of caution from history and experience.

From 1900 to 1919 over 2,000 companies engaged in producing automobiles. By 1955 only 5 companies remained. Automobiles were a sure bet to replace horses and be the next big thing…hype was well deserved! Hype placed into investments was severely punished. Many lost everything.

Between 1995 and its peak in March 2000, investments in the Nasdaq Composite stock market index rose by 800% on the backs of the internet bubble, only to fall to 78% from its peak by October 2002, giving up all its gains during the bubble. The internet was a sure bet on the future…hype was well deserved! Hype placed into investments was severely punished. Many again lost fortunes. Even seemingly sure bets like AOL disappeared. Many like Cisco or Microsoft collapsed for a decade before regaining some footing. Ultimately companies not even in existence, such as Google, Meta, or a transformed business like Amazon, eventually became the winners.

AI is a sure bet to change the landscape of business and life in many ways. The hype around AI is well-deserved! Many companies we own are using AI, investing in AI, and attempting to monetize long-term. Amazon, Google, Microsoft, Meta alone will be spending hundreds of Billions on AI in just the next 12-24 months. We think the key to success will NOT be finding the next big winner in AI but rather trying and avoid the big losers until the hype becomes a reality. Remaining disciplined to focus and search for fundamentals that sustain long-term is key for managing hype cycles. Evergreen remains laser-focused on our discipline.

Summary

So far Mr. Market has chosen to remain optimistic about the future of earnings, Fed actions, and liquidity. As investors, we aim to walk the line between optimists and pessimists as we plod forward. To this end, we must acknowledge it seems the risk is slightly elevated. With the Fed perhaps needing to reduce liquidity a little more, fundamental profit growth solid but not spectacular, market pricing getting ahead of profit growth rates, some geopolitical strife, the odds of a pullback are rising.

Said another way, we never know exactly what the future holds. The market will continue to go up and down. However, we remain laser-focused on real business values and aim to maintain a healthy group of investments that can compound in line with your long-term financial plan. If markets do experience a temporary downturn, we will continue to opportunity seek investments that align with your personal goals.

Let me again say THANK YOU! Our success together is an equal part great team, great advisors, and great clients. We feel extremely blessed to get up every day and do exactly what we love doing. If we did not serve such great families, we would not love what we do nearly as much. It remains a tremendous honor to steward your hard-earned assets and continue helping you meet your long-term objectives. Don’t hesitate to reach out if you have any questions or concerns.

Disclosures

- *Data reported by custodian Goldman Folio Institutional.

- **Data provided by Y-Charts reporting

- *** Net Liquidity = Fed Balance Sheet – Treasury General Account – Reverse Repo. Data taken from guru focus economics and checked against the Federal Reserve Bank of St. Louis

Index and index ETF results such as the All-Country World Index (ACWI) or Barclays Aggregate Bond Index (AGG), or S&P 500 (SPY) do not reflect management fees and expenses and you cannot typically invest in an index but may be able to invest into a similar ETF that reflects the index for a small fee.

Evergreen Wealth Management, LLC is a registered investment adviser. The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.