Our question of the month from clients is, what will happen if rates increase?

Below is a great response from one of our Perrysburg, OH advisor partners, Adam Cufr. We hope this helps explain the basics around rate fluctuation and welcome you to give us a call if you have any specific questions or concerns for your account. We are actively managing the ever changing interest rate environment and the long term opportunities.

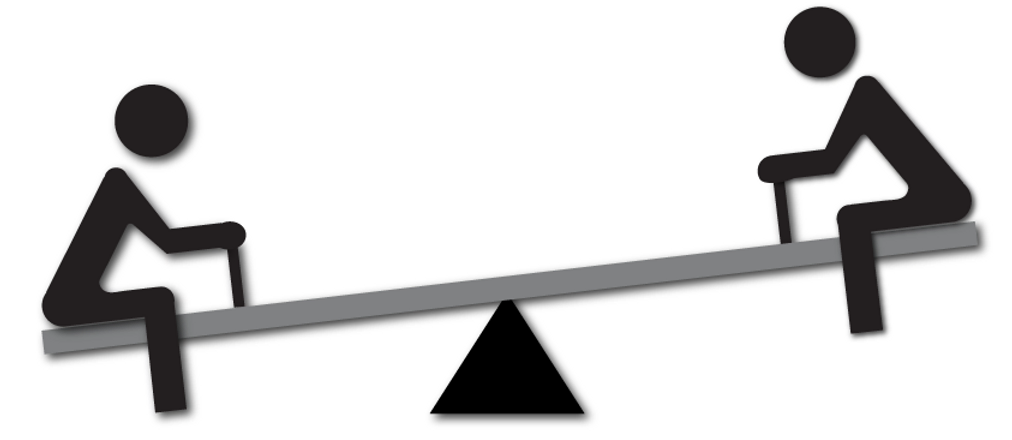

A perfect summer day as a kid may have included the combination of a friend, an ice cream cone, and a teeter-totter. Push up, fall back down…over and over without a care in the world…warm, active bliss. As an adult, a hardened inner ear drum may make the teeter-totter a bit less appealing, kind of like a race to nausea. Add some money to the equation and you’ll begin to see how interest rates and the stock and bond markets are playing a pricey game of teeter-totter with your wealth.

Interest Rates and Bonds To put it simply, interest rates occupy one side of a teeter-totter while bond values are on the other. When interest rates rise, the value of a bond you may already own falls, an inverse relationship like a teeter-totter. When one side goes up, the other must come down. As an example, if you own a $1,000 bond that pays 3% interest to you each year, a rise in interest rates in the bond market to 5% means a person looking to buy a new bond will not wish to pay full price for your bond that only pays 3%. Thus, higher interest rates result in lower prices for existing bonds you may wish, or need to, sell.

Interest Rates and Stocks So what does that have to do with owning stocks? Well, when people are looking to make a reasonable rate of return on their money, they have a choice between putting money into stocks or into bonds. If interest rates have risen high enough to allow new bonds to pay higher interest, many savers will put their money into those bonds again…and not into stocks. In other words, the safety and income of bonds makes them more attractive than owning stocks. As such, some money tends to flow from ‘risky’ stocks to ‘safe’ bonds, causing the stock market to lose value. To say it another way, rising interest rates eventually tend to hurt stock values, mainly because of the choice aspect. Risk-averse investors will now add more bonds (as opposed to stocks) to their portfolio in order to make a reasonable rate of return.

What’s Happening Now What we’ve seen over the last week is the stock market’s reaction to the Fed threatening to raise interest rates. By merely mentioning higher interest rates that will make future bonds (that pay higher interest) more valuable to investors, money begins to flow out of the stock market. As a long-term investor, owning bonds in your portfolio will generally reduce the fluctuations of your portfolio’s value. Bonds can also provide a very valuable source of income to you because of the interest bonds pay to their owners. To not have any bonds in a portfolio may lead to higher long-term growth, but at the expense of your stomach lining. On the flipside, owning too heavy a bond mix in times of rising interest rates may result in lackluster performance.

So what’s a person to do? Of course, it depends. If your objective is to maximize long-term growth potential, and are willing to subject your portfolio to larger swings in value while it’s growing, then own very few bonds. On the flipside, an objective of generating reliable income from your portfolio might require more bond ownership, and ownership of stocks that pay dividends, another reliable source of income. If you’re still reading this, and you wonder how your portfolio is built and how interest rates will impact you, please let us take a closer look. Everybody has different needs and objectives, so please ensure that you understand how the markets’ swings impact you and your planning. The teeter-totter can be a wonderful way to spend a summer afternoon, but can drive you insane if you’re not clear about how ups-and-downs impact your financial security. Let us help you if you desire more understanding.

Important Disclosures

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. Index results do not reflect management fees and expenses and you cannot typically invest in an index.