Last month I wrote the article “Will Social Security Survive” (1), which went into detail about our current Socials Security system, the real numbers and many solutions to help Social Security survive. At the end of that article I said I would give alternative solutions not as popular in congress that may be a viable solution.

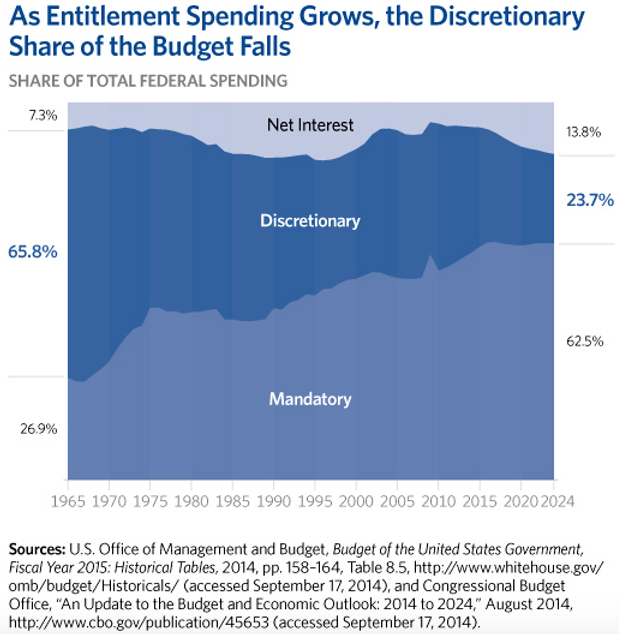

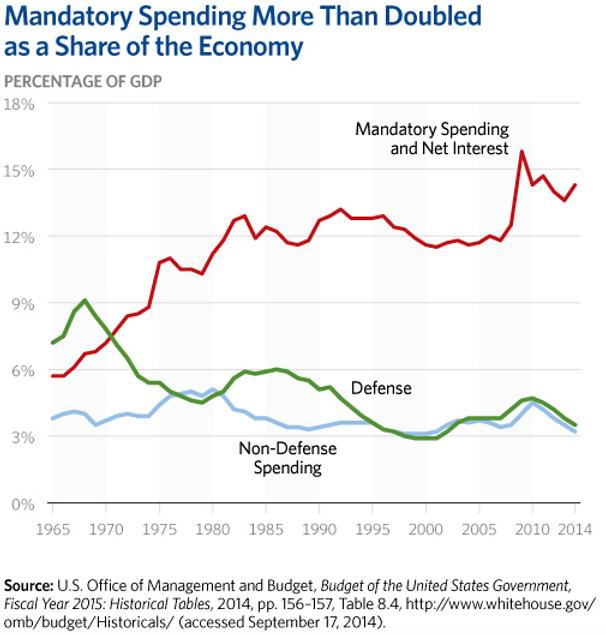

First, let me explain my personal perspective on the situation (which does not include Evergreen as a whole). Social Security makes up 25% of our federal budget (4.9% of GDP) and is continuing to increase. When you include Medicare, Medicaid, and all the other income security programs (americas “safety net”) along with Net Interest on the debt it adds up to over $2.6 trillion. This is roughly 67% of our federal budget, 14.5% of GDP. (2)

In comparison with Discretionary spending (Categorized as Defense and Non-Defense spending) is roughly $1.2 trillion. Defense accounts for only $584 billion of our entire $3.9 trillion budget. That means when a presidential candidate, congressman or any political activist says they have a plan to cut spending they only have $600 billion of non-defense discretionary spending to work with. This includes Education, Training, Administration of Justice, International Affairs, general science, space, technology, and other general government expenses. (2)

Click HERE to see the 2016 Federal Budget break down by the CBO.

Last year we added $587 billion to our deficit. If we unreasonably cut back the entire non-defense discretionary spending we would just barely have a surplus. Until then the federal deficit continues to increase and a solution from congress doesn’t seem to come any time soon. I believe the federal deficit is a problem, but as long as the private sector of the United States of America

continues to produce the goods and services necessary to grow the economy at a healthy level we won’t experience the ramifications of our large deficit. Remember the Federal Government doesn’t create anything, but taxes the goods and services produced in order to function. As our “safety net” increases as a percentage of GDP it constrains the ability of the private sector to produce the goods and services necessary to keep the programs healthy in the future. With our demographics slightly aging and our workforce percentage decreasing, this only gets worst.

Things to consider:

-

Over the past 20 years, federal spending grew 63 percent faster than inflation.(3)

-

Mandatory spending, including Social Security and means-tested entitlements, doubled after adjusting for inflation.(3)

-

Discretionary spending grew by 47 percent in real terms.(3)

-

Three major budget categories—major health care programs, Social Security, and interest on the debt—will account for 85 percent of nominal spending growth over the next decade.(3)

Personally I feel not just social security, but all of our entitlement programs needs to be adjusted, rolled-back, or a plan to abolish some all together. I understand the viewpoint of, “These programs are paid through FICA taxes and don’t contribute one penny to the deficit.” That is true (only for S.S. and Medicare) for the moment, but projections show this will not be the case soon which is why we are having the conversation of Social Security reform or benefits have to be cut in the first place. Also remember who pays a higher percentage of income to FICA? If you read my last article its the workers who make less than $118,500 ($127,000 in 2017). So the hopes of providing income to the elderly poor and middle class is increased taxes for the poor and middle class workers, and especially those self employed (employers providing jobs to middle and low income earners).

In The Fate of Empires written by Arthur J Hubbard in 1913 (I know what a nerd…) he explains specific scenarios and constant reasonings about how the great empires of the past rise and fall through factors such as: Impulse, Reason, Competition, Reproduction, Race, Religious motives, Individual vs. Society and others. The reasonings can be summed up with these two sentences, he writes:

The turning-point in past civilizations has been marked, again and again, by the appearance of Socialism coincidently with a failure of the birthrate. – preamble

Recorded history, so far as our present purpose is concerned, gives only this resultant of two component forces, one of these being that which makes for growth, and the other that which makes for decay. – pg.6 (4)

The main forces of decay (no matter if the motives are caused by Impulse, Reason, Competition, Reproduction, Race, Religious motives, Individual vs. Society or others) is brought through Socialism and birthrate failure. Socialism is growing more rapidly in the U.S. and the birthrate is not as strong as it should be. When these forces overpower what causes growth for a society is when dissolution occurs.

Alternative Solutions

1. – T.R.U.S.T. Fund of America

I came across an alternative solution recently proposed by financial advisor Ric Edelman. He proposed something called the T.R.U.S.T. Fund of America. (5)

The T.R.U.S.T. Fund for America calls for the government to set aside a one-time amount of $7,000 for each child born in the United States, and to repeat this annually for the next 35 years. The money would be placed in an investment portfolio determined by an expert panel appointed by the president and Congress. After 35 years, the government would receive back its initial $7,000, plus inflation, and use the proceeds to fund the program for children born during the next 35-year cycle.

The total cost of Edelman’s proposal is $1 trillion – 92 percent less than the $12.5 trillion in new taxes and benefit cuts recommended in June 2016 by the Bipartisan Policy Center’s Commission on Retirement Security and Personal Savings. And unlike the BPC’s proposal, the T.R.U.S.T. Fund for America’s concept is a permanent solution to the Social Security crisis.

Pros:

-

Less expensive

-

Possibility of being self funded within 35 years

-

No need to “re-examine” the health of S.S.

Cons:

-

Government Contributions and higher incentive on market performance

-

Who chooses investment options? potential conflicts of interest through lobbyist

-

What if calculations are wrong on investment returns of 7.86% and Inflation of 2.24? (That’s part of the reason certain pension plans are failing is inaccurate expectations.)

2. – Alternating age eligibility to expected life expentancy

Set withdrawal eligibility back to the intention of providing income to those who are most likely unable to work instead of the focal point income for retirees. Possible ways this could be looked at. There are many but I will just list two examples.

1) Set Withdrawal Eligibility to Life expectancy depending on when you were born. In 1940 a person age 65 could receive S.S. when life expectancy at birth was 60.8 for men and 65.2 for women.(6) According to ssa.gov calculator life expectancy for those being born today for men and women is 83.5 and 87.2 respectively.(7) So for my son born who will be born in the year 2017 would maybe receive S.S. benefits at age 83?

2) For men and women who reached age 65 in 1940 was expected to live additional 12.7 and 14.7 years respectively (77.7 and 79.7). (7) So could one propose withdrawal eligibility period beginning when expectation of lifespan is 12-15 more years? For example today males at age 70-71 can expect to live on average around 15 years. For women its age 73. So a possible answer in this scenario would be instead of having the ability to take S.S. at age 62 with full retirement age 67, its age 70 and full retirement is 75.

Pros:

-

Set schedule on withdrawal eligibility

-

Intention of S.S. would be preserved

-

Should stabilize the health of S.S. as long as workforce increases

Cons:

-

Doesn’t solve the problem with occurrence of a decreasing workforce population

-

Relying on accuracy of actuarial tables

3. – Put together a solution to roll back S.S. to not exist

I don’t know what the possible situation is to make this solution work. Any way you try to roll it back consequences will have to be paid by some who probably didn’t deserve it. Although some would say S.S. is doing that right now anyways and we should be thinking about our future posterity. An example would be those under age 30 won’t get S.S. and phase it out for anyone between 30-45, above age 45 would receive no changes. But then who pays into S.S. to make it work for those older than 31? A lot of conflicts occur that requires even more solutions.

Pros:

-

Socialism and government intervention is less relevant in the future

-

Stability of national economy isn’t dependent on stability of national programs

-

Forces of decay doesn’t effect the entire individual population

Cons:

-

Deciding who does and doesn’t receive benefits that already paid into the system

-

How do you fund the current S.S. benefits

-

Country looses the a “safety net” for its elderly citizens

Evergreen Conclusion

Personally I have been fighting back and forth on what I feel is the best solution. Solution 1 sounds good at the surface but could create a bigger problem then what we currently are in. Redirecting the intent of S.S. is probably where I side with most often. Solution 3 sounds ideal, but in reality would never happen with the current congress and voter base along with the heavy consequences families would experience. We have explained many possible solutions congress has in this article and last article.

Reach out to us if you have any questions about your personal Social Security situation. We are always here to help.

(1) – Evergreen Wealth Management, investevergreenfg.com

(2) – CBO.gov

(3) – heritage.org

(4) – Fate of Empires – by Arthur J Hubbard

(5) – edelmanfinancial.com

(6) – https://www.infoplease.com/us/mortality/life-expectancy-age-1850-2011

(7) – ssa.gov

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.