Elections can impact markets but not as much as you might think. If you have a good plan, stick with it.

*Snippet of article by Fidelity Viewpoints, 10/26/2016 that we find relevant today

A recent Fidelity nationwide survey finds 74% of investors think which party controls the government has an impact on the stock market—but perhaps not the way you think. A slim 14% believe whoever sits in the Oval Office has the biggest impact, 28% say control of Congress is key, 33% say it’s a combination, while 26% say political control has no impact at all.

What are investors doing about it? Not much. Only 15% of those surveyed have already made or plan to make changes to their portfolios because of the election. The vast majority plans to stay the course. That’s a good thing, in our view, since history suggests that elections typically have had little lasting impact on overall market performance. Among the most powerful drivers: the business cycle, interest rates, corporate earnings, and when it comes to your personal performance—your investment plan.

“The election may spur volatility—and active investors can try to take advantage of it—but for long-term investors with a solid plan, short-term market swings should be expected,” says John Sweeney, Fidelity executive vice president of retirement and investing strategies. “It’s important to take a long-term perspective. If you have a plan you like, stick with it. If you don’t, work with a professional who can help you build one that will help serve you well, no matter what may roil the markets in the short-term.”

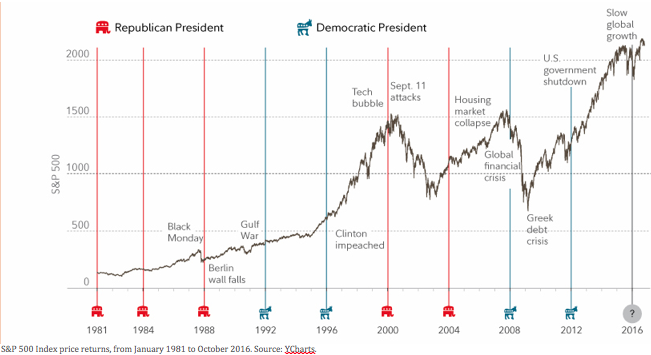

Remaining disciplined during political shifts and financial and geopolitical shocks has proven a smart long-term strategy.

History lessons

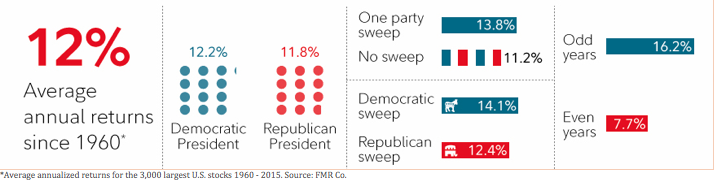

A look back at how the stock market has behaved under different political regimes since 1960 shows that over the long-term there has been no significant difference, on average, between which party controls the White House (see graphic below): The Democratic and Republican average annual returns were both close to 12%. Stocks did about two percentage points better when Democrats swept both the White House and Congress. But a lot more was at play than politics (see graph above). In fact, even using a random criteria like investing in stocks in odd years only would have delivered about 16% average returns, four percentage points above the average, showing the limits of party impact. Says Fidelity sector strategist Denise Chisholm: “Over long time periods, the party composition of our government has not been a critical driver of market performance.”

Investing based on what party wins? Since 1960, you’d have done better picking just odd years.

Why is there not a clearer connection between party control and overall stock market performance? Says Chisholm: “For one thing, there are many other powerful forces at play impacting the stock market, including employment, interest rates, innovation and other competitive forces. Also, stocks have had the tendency to price in the possibility of policy changes well in advance.”

That doesn’t mean a President or Congress can’t change things through new regulations and policies. In particular, tighter regulation can weigh on the sectors it hits. For example, says Chisholm, the potential for drug pricing regulation has compressed multiples in the health care sector. Tighter regulation has also weighed on financial stocks, where returns on equity are now historically low.

But even these trends do not affect all health care or financial companies the same way.

Evergreen Wealth Opinion

Data has shown elections generally have little direct effect on markets. Policies crafted will have longstanding effects that generally take 4-8 years before impact is felt. Many times the current forces of the economy can be traced to policies, congress and presidential actions 5,10,15 years prior. Since 1960 we have seen 16 of 17 times the months of November – January produce a return range of -4% to 15.7% during election years (normal market movement). 12 of 17 times the results are positive returns. This shows a bias toward market rallies after elections regardless of whom was elected. The fact we are removing uncertainty and now know what we are dealing with seems to be favorable historically according to the data. Regardless of the outcome, we know staying the course with your plan and using any disruptions as an opportunity to rotate and buy is the best action.

Important Disclosures

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.