Understanding Market Valuation and US Deficit

Market update interview with Lead Manager Stephen Hanley.

My apologies for the slightly later-than-usual quarterly update. It has been a whirlwind of a year so far in the markets. We’ve been busy sifting through the noise—separating what’s fundamental for long-term investing from short-term distractions that eventually fade.

As anticipated, 2025 has brought increased market volatility. From February 19th to April 8th, the S&P 500 declined by -18.70%, driven by sweeping tariff announcements that created significant uncertainty. As that uncertainty has eased, markets have rebounded sharply. As of this writing on May 12th, the ACWI is up +3.39% and the S&P 500 is down just -0.76% YTD.*

While we navigate through the high amount of current noise, it’s important to stay grounded in our core long-term investment focus. It’s easy to get lost amid the hundreds of variables swirling during turbulent periods. Here are just a few of the many “what ifs” the market is wrestling with in 2025:

- What if tariffs remain elevated for longer?

- What if our trade imbalance leads to less demand for U.S. Treasuries?

- What happens to the dollar’s standing as the world’s primary reserve currency?

- What if the Fed doesn’t cut rates?

- What if the administration does (fill in the blank)?

The list goes on—and it fuels much of the current media narrative. While many of these possibilities need to be deeply examined we want to be careful not to let them outweigh our long-term view. If we go back through history it is important to remember that very large ‘What If’s’ have always existed. Investors who place too much emphasis on the unknowns at the expense of the knowns generally do not fare as well. So, while many of these are important questions and we certainly hold strong views on several of them, our role is to manage money with a 5-, 10-, or 30-year perspective—not 1-3 years. Our responsibility is to build sustainable portfolios designed to meet client goals over a lifetime. That requires a different lens from most market participants.

After we are done thinking about many of the ‘What If’s’ we always return to what really matters: owning wonderful companies at a fair price that we believe can endure and provide the returns our plans require. Certainly, if the ‘What if’ scenarios start to change our long-term fundamental views we take notice (more on this later in the article)…but more often than not, companies find a way to navigate around many of the possible negative scenarios. Business durability in the face of macro headwinds is often largely underrated. Therefore, if we own investments that hold long-term durability the real concern of focus needs to be valuations relative to long-term profits. Let’s talk about valuations for a minute before we move on to address what we believe is the fundamental ‘What If’ question that we must discuss.

Market Valuation Update

To begin our valuation look; consider S&P 500 operating EPS data over the last 5, 10, and 20 years:

|

Period |

EPS Growth |

Index Price Growth |

Starting Operating Earnings P/E |

|

5 Years |

+49% |

+82.05% |

20.56 (2020) |

|

10 Years |

+107% |

+185.70% |

18.21 (2015) |

|

20 Years |

+245% |

+385.30% |

17.91 (2005) |

Over time, investors’ share of profit growth (EPS Growth) has driven strong returns in equities. But here’s a cautionary note: recent returns have outpaced earnings growth due more to valuation expansion than recent profit growth. Investors are simply paying much more for each dollar of earnings today. As of 1/1/2025 investors are paying over $25 for each $1 of operating earnings! This is almost 40% HIGHER than 2005. Should we be worried?

We believe there are several fundamentally sound reasons why today’s equity market may warrant a slightly higher valuation multiple than it did 20 years ago. Improved balance sheet quality, broader global business reach, a shrinking pool of public equities, and potentially permanently higher margins driven by technological advancements all support a modest premium to historical norms.

That said, no matter how you frame it, paying $25 for every $1 of earnings begins to test reasonable boundaries. So, where should we draw the line—and how should we respond?

In our view, the aggregate equity market should offer an earnings yield that is at least in line with, if not slightly above, lower-risk alternatives. This seems like basic investment common sense. Imagine a world where a bank offers a guaranteed 12% return on a 5-year CD. Would you choose that, or would you invest in a stock yielding just 4%, with the hope of 5–10% annual profit growth over the same period?

Let’s run the numbers. A 12% CD turns $100,000 into $176,000 over five years. A stock with a 4% earnings yield (i.e., a 25x multiple) that grows earnings at 10% per year ends with about $6,450 in annual profits. At the same 25x multiple, that gives you a stock worth approximately $161,000— equivalent to a 10% return. The no-risk CD clearly wins, and in such a scenario, stock valuations would be pressured lower to compensate.

While today’s reality isn’t nearly that extreme, the example is useful in reinforcing why valuations must have mathematical and risk-adjusted limits. As of May 15, 2025, the 10-year Treasury yield is 4.49%, while a 25x P/E multiple equates to an earnings yield of just 4%. That math makes owning a more volatile asset class like U.S. equities feel a bit stretched.

At Evergreen Wealth, we prefer equities offering an earnings or cash flow yields of 5–7%, with the potential for that yield to grow over time. As selective stock pickers—not forced to own the entire market—we have the advantage of searching for these types of opportunities. Just as importantly, we can avoid the areas of the market that don’t meet our standards. What we choose not to own is just as critical as what we do own, and we believe that selective discipline will be a significant advantage as we navigate the coming years.

Today’s market presents a unique challenge: with equity earnings yields now trailing many low-risk alternatives like bonds, the burden shifts heavily to future earnings growth. Think of the gap between earnings yield and bond yield as a hurdle. When earnings yields exceed bond yields, the hurdle is low. But when earnings yields lag, the hurdle becomes much higher—and the risk of falling short rises with it. We believe it’s still possible for the market to clear this higher bar—but it’s far more difficult than it has been over the past decade.

Our biggest concern is how the market might attempt to meet this rising demand for earnings growth. Too often, when pressured, governments resort to short-term tactics—large fiscal deficits, aggressive monetary expansion, and bloated central bank balance sheets—to artificially boost growth. These strategies may temporarily appease markets, but they tend to prioritize short-term performance at the expense of long-term stability.

This cycle of stimulus and misaligned incentives often leads to asset bubbles and systemic imbalances. Accumulating massive debt or printing excess money is a form of economic procrastination—a “kick the can down the road” mentality that ultimately leaves future generations to clean up the mess created by today’s short-termism.

We Have A Spending Problem – The Deficit Dilemma…The Big WHAT IF

Problem 1: Looking ahead, about one-third ($9.3 trillion) of all existing debt held by the public is scheduled to mature between April 1, 2025, and the end of March 2026.

Problem 2: We are running a massive deficit near $2 Trillion a year. Any cuts so far have been offset by added spending. Long-term actions such as trade deals, tariffs, and tax policy seem to be largely offsetting with little deficit improvement.

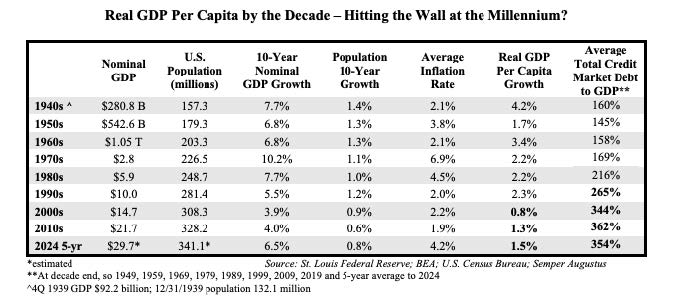

We have seen a fundamental movement away from fiscal responsibility regardless of political affiliations during the past 20 years. For example, Real GDP per Capita has continued to decline while at the same time, our Debt to GDP has exploded to an unsustainable amount. This simply can’t continue without some major changes.

One of the major issues the US will face going forward is a demographic problem that might bridge into a large moral dilemma (what do we cut?). We are now facing the back end of a very large retiring ‘Baby Boomer’ generation. We owe this generation lots of Social Security and Medicare entitlements that they were promised and paid for via taxes. They absolutely deserve what they paid for! However, the math to maintain the highest level of these benefits is getting a bit rough.

The government is up against budgets comprised of non-discretionary spending and is quickly running out of areas to cut to bring back some level of fiscal discipline. Both Social Security and Medicare are ‘pay as you go’ systems that rely on incoming tax receipts to pay current benefit takers. Over the last 10 years, US Taxpayer receipts (federal tax revenue) have risen 57% while spending surged 94%. This caused our debt to double from $18 Trillion to over $36 Trillion. Tax receipts and revenue for the US government have never been better and yet multiple administrations of both parties continue to overspend. It’s very hard not to spend like crazy when that action keeps you in office and those politicians on both sides who have largely preached fiscal restraint have almost all been voted out in favor of candidates making unsustainable promises.

Today’s cost-cutters face an extreme uphill battle against this basic math. Taxpayers sent the government roughly 17% of GDP last year to the tune of $4.9 Trillion. The government spent around $6.8 Trillion, leaving a $1.9 Trillion deficit to be financed by selling more government bonds. So this is where the math gets crazy. Mandatory spending by the US government is now at over $4 Trillion and climbing. The net interest we owe on our debt to simply honor our bonds is at $884 Billion and climbing. You do the math…The US government brings in $4.9 Trillion and is mandated (mandated by congressional law) to spend $4.9 Trillion. And here is the scary part…Mandatory does not include Defense. Defense spending is part of the ‘discretionary’ bucket. The discretionary bucket spending is set by appropriations legislation. Discretionary is probably a poor way to describe many of these expenses. I will assume most citizens want the US to have some reasonable military defense for our protection. Total discretionary spending was around $1.9 Trillion in 2024 with defense accounting for about half of the discretionary spend. This leaves around $950 Billion in play for finding ‘most efficiency’. Perhaps current and future administrations can take things more seriously and find 20-30% ‘efficiency’ savings inside this bucket. If they did this it might be possible to reduce by $200 – $300 Billion. This would still leave a fundamental deficit of over $1.7 Trillion.

Let’s imagine a world where we somehow stop spending at today’s level, find $200B efficiencies, and only adjust for 2% inflation going forward. What would the US financial picture look like after 10 years assuming GDP grew at a nominal 5% and debt rates around 4% ..without any recessionary interruptions (a very ideal and unlikely perfect scenario).

We estimate in 10 years tax revenues would increase to just over $8 Trillion and spending would increase to just over $8 Trillion. This would be an ideal outcome and the one fiscal government should be aiming for. This shows a path does exist if we (congress) take action now! Sadly we view the probability of this as low. The idea congress will freeze spending beyond inflation adjustments would mean some pretty extreme outcomes that voters are very likely to not accept. It would mean eliminating some and reducing access to many brand new life-saving medicines for Medicare recipients. It would mean adjusting the age for social security by a large amount for the younger generation (probably closer to 80 for those under 35). It would mean accepting a defense system that will lose ground to other nations such as China. But alas all is not lost. This is not an all-or-nothing equation. We remain hopeful that some common sense changes will be made to bring us closer to the ideal outcome. Medicare drug costs will need to be addressed, the social security age will need to be adjusted for younger generations, defense spending can perhaps be offset via trade agreements with other countries, some exports can possibly be increased allowing better balance for trade. While a perfect path will not happen, we must leave room for market dynamics to force a path to some level of improvement.

So what does this mean as investors? It means we must hold the possibility for US Bonds and Currency to be pressured long-term and manage investments in a way that acknowledges this possibility as a real risk going forward. The market today with a higher valuation is probably underestimating the potential negative effects of our current deficit. We acknowledge the FED and Treasury cannot run the printing press forever and markets will ultimately price this debt behavior in via interest rates, inflation, and by connection the US equity returns. This takes our argument full circle back to where we began…valuations will matter more in the next 10 years than in the past 10 years. Owning wonderful companies with pristine balance sheets at a fair price will matter more in the next 10 than in the last 10 in our opinion. To highlight the importance of remaining valuation-focused, we find it a good idea to remember what happened during the last true systemic asset bubble.

The Importance of Valuation – A Cautionary Tale from History

As a cautionary tale on the importance of valuations consider the stock market in 1999-2003. At the beginning of 2000, the market was paying $28 for each $1 of operating earnings; only 12% higher than the start of 2025. Earnings grew a solid 8.6% in 2000 but the slowdown of growth started a serious market decline because the valuations had been based on an expectation of 10%+ growth for a very long time. The hurdle to clear relied on extreme profit growth for a very long time. When the hurdle could no longer be cleared and Mr. Market experienced just a 2-year interruption, the S&P 500 declined -10.14% in 2000. As the economy continued to slow in 2001 the earnings dropped 30% from the year before as a recession set in. The market then declined another -13.04% in 2001. Earnings started to rebound in 2002 and were only around 16% away from the highwater profits of 2000 and yet the market still declined -23.37%. By 2002 the market had declined over -40% while profits only declined -16%. By 2003 the multiple of dollars paid per profit was back to a normal and healthy 19.

“Fundamental value investing will always be relevant. To succeed, always buy for less than what it is worth, and be smarter than the market. It will never go out of style.” Charlie Munger

“History may not repeat itself, but some of its lessons are inescapable. One is that in the world of high and confident finance, little is ever really new. The controlling fact is not the tendency to brilliant invention; the controlling fact is the shortness of the public memory, especially when it contends with a euphoric desire to forget.” John Kenneth Gailbraith

Final Thoughts

The market has swung on a number of “What Ifs” so far this year. We’ve already seen sharp shifts— from tariff-driven pessimism to renewed optimism around AI, trade agreements, and policy support. That wave of optimism has helped sustain today’s elevated valuations. But at current levels, the broader market is beginning to stretch our comfort zone.

One fundamental issue is poised to take center stage: debt financing. In 2025, the U.S. will need to refinance approximately $9.3 trillion—roughly one-third of its total outstanding debt. While it’s possible that policymakers attempt to “juice” the system through temporary Fed action or larger deficits, the window for playing that game is closing fast. Eventually, the hard math of mismanaged deficits will collide with bond markets, currency markets, and equity valuations alike.

At Evergreen, a significant portion of our research is devoted to navigating this potential inflection point—protecting against downside risks while remaining open to upside surprises. Regardless of how events unfold, we believe two disciplines will be essential over the coming decade: maintaining valuation discipline and diversifying wisely.

We continue to walk the line between optimism and realism. Elevated risks do not eliminate opportunity—but they do demand thoughtful, intentional positioning. Timing macroeconomic cycles is notoriously difficult, so our commitment remains to balance: making patient, prudent decisions grounded in long-term fundamentals.

Our guiding approach remains unchanged:

- Own strong businesses at fair prices

- Avoid speculation

- Diversify intelligently

- Maintain elevated levels of “dry powder” in safer assets that can be deployed strategically

- Stay opportunistic when others are fearful

- Seek to purchase current and future high-quality businesses at better valuations when the market offers them

Should conditions deteriorate, we’re prepared—with capital, liquidity, and a strategy—to take advantage of emerging opportunities. We remain firmly anchored in real business fundamentals and focused on delivering long-term outcomes aligned with your financial plan.

Thank You

Let me again say—thank you. Our success is a shared result of great clients, great advisors, and a dedicated team. We’re incredibly grateful to wake up each day and do the work we love. It’s an honor to steward your hard-earned capital and walk with you toward your long-term goals.

Please reach out anytime with questions or thoughts.

Warmly,

Evergreen Wealth Management

Disclosures

- ACWI & S&P 500 performance numbers *Data provided by YCharts reporting.

- Market Valuation Section Data provided by YCharts reporting

- We Have a Spending Problem Section Data provided by BEA, St. Louis Fed, Google AI summary, Y Charts, Semper Augustus Annual Letter

- The Importance of Valuation Section Data provided by YCharts reporting

Index and ETF results (e.g., ACWI, AGG, S&P 500) do not reflect management fees or expenses and are not directly investable.

Evergreen Wealth Management, LLC is a registered investment adviser. This information is for educational purposes only and does not constitute an offer or solicitation to buy or sell any securities. Investments involve risk and are not guaranteed. Always consult with a qualified financial advisor or tax professional before implementing any strategy. Past performance does not guarantee future results.

The views expressed reflect the opinion of the firm as of the date indicated and are subject to change. Forward-looking statements are not guarantees and involve uncertainties that may cause actual results to differ.