In an ideal world, your retirement would be timed perfectly. You would be ready to leave the workforce, your debt would be paid off, and your nest egg would be large enough to provide a comfortable retirement — with some left over to leave a legacy for your heirs.

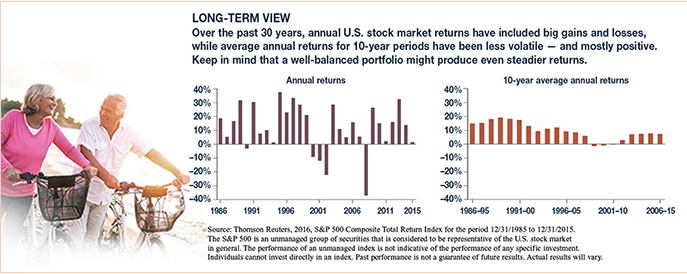

Unfortunately, this is not a perfect world, and events can take you by surprise. Only four out of 10 current retirees said they retired when they had planned; half retired earlier.(1) But even if you retire on schedule and have other pieces of the retirement puzzle in place, you cannot predict the stock market. It would be wise to prepare for the possibility that you might retire during a market downturn.

Sequencing Risk

The risk of experiencing poor investment performance at the wrong time is called sequencing risk or sequence of returns risk. All investments are subject to market fluctuation, risk, and loss of principal — and you can expect the market to rise and fall throughout your retirement. However, market losses on the front end of your retirement could have an outsized effect on the income you might receive from your portfolio.

If you’re forced to sell investments during a downswing, you might deplete your assets more quickly than you would if you had waited, reducing your portfolio’s potential to benefit when the market turns upward. People who retired around the time of the Great Recession faced this situation, and many decided to work longer to rebuild their assets rather than trying to retire with a smaller portfolio and reduced income.(2)

Dividing Your Portfolio – Evergreen Wealth Approach for achieving income objectives

One strategy that may help address sequencing risk is to allocate your portfolio into three different “buckets” that reflect the needs, risk level, and growth potential of three retirement phases.

1. Short-term (first 2 to 3 years): Assets such as cash and cash alternatives that you could draw on regardless of the market at the time you retire. Maybe even reviewing secure annuity structures as well.

2. Mid-term (3 to 10 years in the future): Mostly fixed-income securities that may have moderate growth potential with moderate volatility; you might also have some traditionally lower risk or lower correlated equities in this bucket.

3. Long-term (more than 10 years in the future): Primarily growth-oriented or dividend and growth oriented investments such as stocks that might be more volatile but have higher growth potential over the long term.

Throughout your retirement, you can periodically shift assets from the long-term bucket to the other two buckets so you would continue to have short-term and mid-term funds available. Evergreen does this by assessing market risk and striking a balance during higher times and using the “safer” buckets during points of opportunity such as 2002, 2008, 2015 when markets decline over 15%, and provide improved investment entry points.

Determining Withdrawals

One common rule of thumb for determining the amount of your annual withdrawals is the so-called “4% rule.” According to this strategy, you initially withdraw 4% of your portfolio, increasing the amount annually to account for inflation.

Regardless of the amount you decide to withdraw from your portfolio, the three-part strategy enables us to monitor performance in your mid-term and long-term buckets while drawing only from the more stable short-term bucket of cash alternatives. We then shift assets as appropriate based on your needs and longer-term market cycles.

Even with careful planning, retirement can bring surprises, so it’s wise to be prepared and balanced.

We are blessed to serve wonderful clients and advisors to help achieve long term outcomes using the above framework. If you are not working with Evergreen Wealth or one of our independent advisor partners, we recommend you reach out and schedule a time for a conversation.

Williamston Michigan Advisors Perrysburg Ohio Advisors

Jeff Gorsline: 517-655-2118 Adam Cufr: 419-931-0704 (Fourth Dimension Financial Group)

Michael Gorsline: 517-655-2118 Andrew Nutter: 517-992-6217

Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

1) Employee Benefit Research Institute, 2015 2) USA Today, February 27, 2014

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright 2016 Emerald Connect, LLC.

Evergreen Wealth Management, LLC (“RIA Firm”) is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.