Is it Wise to Trade Your Pension for a Lump Sum?

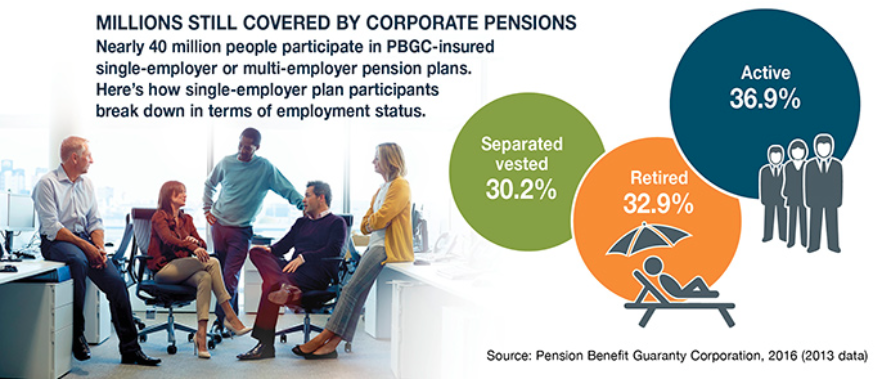

Most employers have already replaced traditional pensions, which promise lifetime income payments in retirement, with defined contribution plans such as 401(k)s. Even so, 35% of workers say they (and/or their spouse) have pension benefits with a current or former employer. Pension payments are a major or minor source of steady income for about 47% of retirees.(1)

About half of pension plan participants can choose to take their money in a lump sum when they retire.(2) In addition, companies can offer pension buyouts — not only to vested former employees who are working elsewhere but even to retirees who are already receiving pension payments.

By shrinking the size of a pension plan, the company can reduce the associated risks and costs and limit the impact of future retirement obligations on current financial performance. However, what’s good for a corporation’s bottom line may or may not be in the best interests of plan participants and their families.(3)

For most workers, there are clear mathematical and psychological advantages to keeping the pension. However, a lump sum could provide financial flexibility that may benefit some families.

Weigh Risks Before Letting Go

A lump-sum payout transfers the risks associated with investment performance and longevity from the pension plan sponsor to the participant. The lump-sum amount is the discounted present value of an employee’s future pension, set by an IRS formula based on current bond interest rates and average life expectancies.

Individuals who opt for a lump-sum payout must then make critical investment and withdrawal decisions and determine for themselves how much risk to take in the financial markets. The resulting income is often not enough to replace the pension income given up, unless the investor can tolerate exposure to stock market risk and is able to achieve solid returns over time.(4) Lump sum create flexibility, where as the pension may bring more certainty in not outliving your money.

Gender is not considered when calculating lump sums, so a pension’s lifetime income may be even more valuable for women, who tend to live longer than men and would have a greater chance of outliving their savings. In addition, companies may not include the value of subsidies for early retirement or spousal benefits in lump-sum calculations; the latter could be a major disadvantage for married couples.(5)

When a Lump Sum Might Make Sense

A lump-sum payment could benefit a person in poor health or provide financial relief for a household with little cash in the bank for emergencies. But keep in mind that pension payments (monthly or lump sum) are taxed in the year they are received, and cashing out a pension before age 59½ may trigger a 10% federal tax penalty. Rolling the lump sum into a traditional IRA postpones taxes until withdrawals are taken later in retirement.

Someone who expects to live comfortably on other sources of retirement income might also welcome a buyout offer. Pension payments end when the plan participant (or a surviving spouse) dies, but funds preserved in an IRA could be passed down to heirs.

IRA distributions are also taxed as ordinary income, and withdrawals taken prior to age 59½ may be subject to the 10% federal tax penalty, with certain exceptions. Annual minimum distributions are required starting in the year the account owner reaches age 70½.

It may also be important to consider the health of the company’s pension. There are many municipal pension programs and other plans that are failing or about to decrease benefits. The “funded status” is a measure of plan assets and liabilities that must be reported annually; a plan funded at 80% or less may be struggling. Most pensions are backstopped by the Pension Benefit Guaranty Corporation (PBGC), but retirees could lose a portion of the “promised” benefits if their plan fails.(6)

Evergreen Conclusion

Taking the lump sum option gives an individual more flexibility and potentially high income in later years while also leaving something behind to your heirs. However, the risk is now transferred to the individual or the individuals advisor to create an appropriate allocation for the lump sum that can emotionally handle market downturns and provide income needs. The prospect of a large check might be tempting, but cashing in a pension could have costly repercussions for your retirement. It’s important to have a long-term perspective and an understanding of the tradeoffs when a lump-sum option is on the table.

1) Employee Benefit Research Institute, 2016 2–3, 6) Time.com, July 24, 2015 4–5) The Wall Street Journal, June 5, 2015

This information is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2017 Broadridge Investor Communication Solutions, Inc

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.